Nigerian Bourse Sees Slight Gain after about N2trn Loss

After losing about N2 trillion, the equities segment of the Nigerian Exchange (NGX) gains N7 billion on Thursday as the market halts selloffs that have persisted for three days.

Consequently, the All-share index grew by 0.03% with a moderate increase year to date return, according to trading data obtained from the local bourse.

Specifically, the market capitalisation which opened at N24.139 trillion rose by N7 billion or 0.03 per cent to close at N24.146 trillion.

Also, the All-Share Index increased by 14.06 points or 0.03 per cent to close at 44,332.21 against 44,318.15 achieved on Wednesday. As a result, the year-to-date return stood at 3.78 per cent.

The gains were driven by price appreciation in large and mid-cap stocks amongst which are Dangote Sugar, WAPCO and Stanbic Bank.

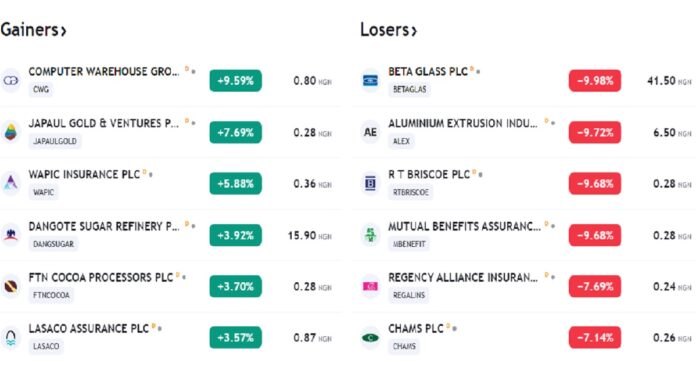

Consequently, market sentiment was flat with 17 stocks recording gains and losses, respectively. CWG led the gainers’ table in percentage terms, gaining 10 per cent each to close at 80k per share.

Livestock Feeds and BOC Gases trailed with 9.59 per cent to close at 80k per share. UPDC Real Estate Investment followed with a gain of 8.93 per cent to close at N3.05, while Japaul Gold and Ventures grew by 7.69 per cent to close at 28k per share.

WAPIC Insurance rose by 5.88 per cent to close at 36k, while Dangote Sugar increased by 3.92 per cent to close at N15.90 per share.

On the other hand, Beta Glass Company led the losers’ chart in percentage terms, losing 9.98 per cent each to close at N46.10 per share.

Aluminum Extrusion Industries shed 9.72 per cent to close at N7.20 per share. Mutual Benefits Assurance and RTBriscoe dipped by 9.68 per cent each to close at 32k per share, respectively. READ:Cititrust to List N2 Billion Shares on Nigerian Exchange

Regency Alliance Insurance dropped by 7.69 per cent to close at 26k per share.

However, market activities were down compared to the previous day as the total volume and total value traded for the day were down by 27.45% and 12.60% accordingly.

In a market report, Atlass Portfolios Limited stockbrokers said approximately 119.22 million units valued at ₦3,201.22 million were transacted in 2,909 deals. This was in contrast with a total of 525.01 million shares worth N5.34 billion transacted in 5,965 deals on Tuesday.

Fidelity Bank topped the activity chart with 39.36 million shares valued N149.02 million.

Guaranty Trust Holding Company (GTCO) came second with 83.19 million shares worth N15.4 million, while Japaul Gold and Ventures accounted for 6.8 million shares valued N1.85 million.

Jaiz Bank sold 4.44 million shares worth N3.89 million, while Access Holdings transacted 4.35 million shares valued at N35.44 million.

Furthermore, the sector performance was positive, as three out of the five major market sectors were up, led by the Insurance sector (+0.22%), followed by the Consumer goods sector (+0.20%), and then the Industrial sector (+0.09%). The Banking and Oil & Gas sectors depreciated by -0.82% and -0.39% respectively.

#Nigerian Bourse Sees Slight Gain after about N2trn Loss#