New Naira Notes: Banks Shun ATMs Loading, CBN Denies Scarcity

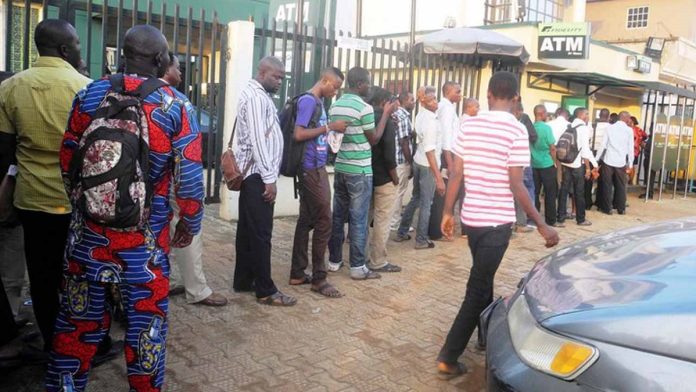

As January 31 deadline is fast approaching, some Nigerian banks have failed to load their automated teller machines, ATMs, across the country. The decision follows the apex bank threat over old naira notes that most of the ATMs are churning out.

Raised their charges, Point of Sales (Pos) operators tod MarketForces Africa that the apex bank has limited their daily withdrawals to a level that is unprofitable for their operations. A large number of ATMs are still paying old naira notes despite the apex bank threat.

Meanwhile, the Central Bank of Nigeria (CBN) has denied scarcity of the new naira notes as alleged by some Nigerians. The CBN Governor, Godwin Emefiele, represented by Musa Jimoh, Director, Payment System Management Department of the bank, denied the allegation in a news conference in Jos.

”The CBN has massively supplied the new notes to commercial banks to dispense both at counters and ATMs. This is to enable quick circulation and we want to advise commercial banks to desist from keeping the cash away from the public or face the stiffer sanction, “he said

Emefiele advised citizens to deposit their old notes at any commercial bank and acquire new ones with immediate effect, insisting that the Jan. 31 deadline remained sacrosanct.

The CBN governor explained that the decision to redesign the currency shows that the apex bank is in tandem with global standards, adding that currency notes ought to be redesigned within five years.

He, however, regretted that it took Nigeria nine years since such changes were last effected. Speaking during a ‘monitoring and sensitisation’ exercise held in some locations in Jos, the CBN governor said that the decision to redesign the country’s higher denominations of currency was a national project aimed at addressing problems related to cash circulation.

He added that it would also solve the challenge of prolonged savings in piggy banks, cash hoarding and incidences of fake currencies. >>>Naira Depreciates to N462 at Investors, Exporters FX Window

“The Monitoring and Sensitisation project was activated by the apex bank for investigation of the attitude of banks toward the spread of the new currencies.

”We are equally using it to create awareness on the use of agents to circulate the cash in communities with few or no bank branches available,” he explained. He advised that faulty currencies be returned to banks for replacements and cautioned people entertaining the thought that the CBN might extend the deadline to desist as they could face losses.