Yield Rises as Treasury Bills Market Records Mild Sell-off

Average yield rises a basis point as Nigerian Treasury bill market records mild sell-off on Thursday as fixed income investors scramble for high return.

Analysts said sentiments were broadly mixed in the fixed income market in line with the previously observed trend.

Front end rates rose marginally, despite robust liquidity in the financial system, says Chapel Hill Denham in a note.

The NTB and OMO benchmark curves expanded by an average of 1bp and 12bps to 0.38% and 0.75% respectively.

Meanwhile, interbank funding rates closed flat as financial system liquidity remained robust, albeit opening slightly lower at N1.1 trillion from N1.3 trillion previously.

Notably, the Open Buy Back (OBB) and Overnight (OVN) rates were unchanged at 0.38% and 0.75% respectively.

Analysts at Greenwich Merchant Bank expect rates to remain pressured in the absence of any significant outflows

“We expect funding pressures to remain benign in the near term, barring a major CRR debit by the central bank”, analysts at Chapel Hill Denham said.

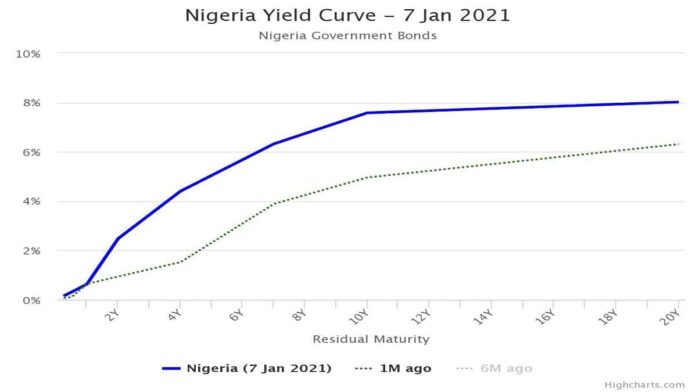

Similarly, the benchmark bond yield curve expanded marginally by an average of 1bp to 6.59%, as the bullish sentiment at the short end of the curve (-17bps to 4.01%) was offset by sustained apathy for long duration.

Amidst uncertainty in markets on the direction of monetary policy, yields are will likely to trade range bound, ahead of the publication of the DMO’s Q1-2021 borrowing calendar.

In the currency market, the Naira strengthened against the dollar in the I&E Window by 4.0% or N16.42 to 393.67, but closed flat in the official window at 379.00.

However, the parallel market rate was unchanged at 470.00.

External reserves sustained uptrend in the New Year, rising by 1.1% month-to-date to US$35.78 billion on 06 January 2021, reflecting the impact of foreign currency loan inflows.

Yield Rises as Treasury Bills Market Records Mild Sell-off