NASD Investors Loss Widens by N1.41 Billion

It was a negative outing this week for NASD Investors in the over-the-counter (OTC) securities exchange as trading activities resulted in a N1.41 billion decline amidst weak market sentiments. Thus, this week’s loss widened negative performance further.

NASD OTC Securities Exchange Index closed the week with a negative movement. The NSI return decreased by 0.15% to close the week at 710.58 points against 711.66 recorded the previous week.

Trading data show that the over-the-counter securities exchange closed on a negative note over persistent pressures on the market performance. Year to date, NASD returns decreased by 4.34% while total volume traded in the period printed at 3,795,770,203.00 units in 2492 deals and the total value settle at ₦ 27,551,730,537

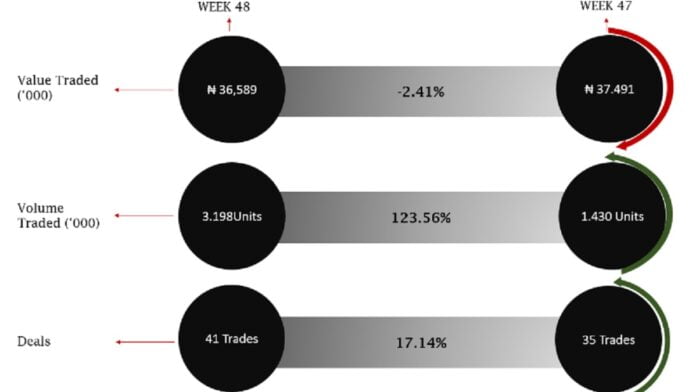

As of Friday’s close market capitalisation dropped by N1.141 billion to ₦933.71 billion from ₦935.12 billion at the beginning of the week due to negative movement in prices. Traders’ report indicates that there was a 2.41% decrease in the total value traded during the week.

In the just concluded week, NASD Investors traded a total of ₦36,589,912.88 in value compared to ₦37,491,621.00 in the previous week. Meanwhile, the transactions on the unlisted companies’ shares for the year reached ₦ 27,551,730,537.00

The total volume traded during the week was 3,198,639 units compared to 1,430,766 units in the previous week, representing a 123.56% increase in trade volume. The total volume traded for the year is 3,795,770,203 units, according to market data.

UBN property Plc ranked top among the five most traded securities by volume and Food Concepts Plc was the fifth most traded stock by volume traded in the week. READ: Nigeria’s Trade Deficit Widens 62% to N3trn in 3-month

Friesland Campina Wamco Nigeria Plc ranked top among the five most traded securities by value and Food Concepts Plc was the fifth most traded security by value traded in the week.

Afriland Properties Plc, which currently holds a market capitalization of ₦1.89 billion closed the week at ₦1.38 representing a 10 percent increase from the previous close of ₦1.25

11 Plc, which currently holds a market capitalization of ₦55.53 billion closed the week at ₦154.00 representing a 0.65 percent decrease from the previous close of ₦155.00

Fries Campina Wamco Nigeria Plc, which currently holds a market capitalization of ₦65.05 billion closed the week at ₦66.63 representing a 0.55 percent decrease from the previous close of ₦67.00

UBN Property Company Plc, which currently holds a market capitalization of ₦5.12 billion closed the week at ₦0.91 representing a 9.0 percent increase from the previous close of ₦1.00. # NASD Investors Loss Widens by N1.41 Billion