Liquidity Surge Keep Financial Market Quiet

Robust liquidity in the financial system is keeping the market quiet as investors’ joggles portfolio searching for a better yield but none has really been available.

Surplus money is however keeping rates low, for example in the money market, interbank funding rates declined further to low single digits further yesterday.

Analysts at Chapel Hill Denham attribute this to buoyant system liquidity.

Financial system liquidity opened higher at N219 billion from N195 billion in the previous day, and was further supported by OMO maturities worth N350 billion and a bond coupon payment.

Read Also: Interbank Funding Eased on Strong Financial System Liquidity

The Open Buy Back and Overnight rate then declined by 200 basis points (bps) and 175bps to 1.50% and 2.25% respectively.

“We expect funding pressures to remain benign in the near term, with an additional bond coupon payment expected tomorrow”, Chapel Hill Denham stated.

Meanwhile, sentiments were mixed in the fixed income market despite buoyant liquidity in the financial system.

Discount rates on benchmark Nigerian Treasury Bills (NTBs) were unchanged at an average of 1.73%.

However, open market operations (OMO) bills traded bullish as the benchmark curve compressed by 3 bps to 2.33%.

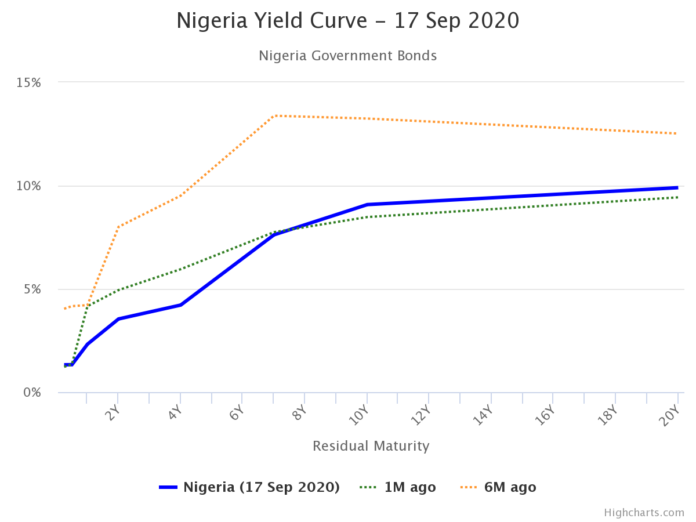

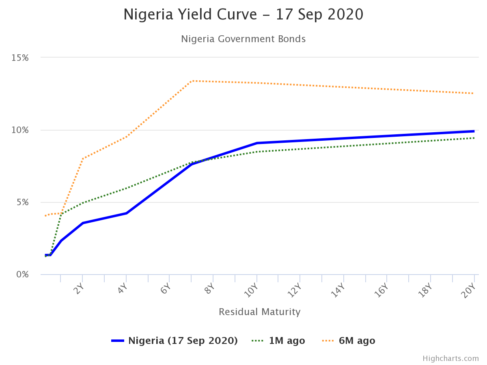

Analysts said the bond market saw renewed selling, as yields expanded across benchmarks by an average of 5bps to 7.28%, driven by bearish sentiments at the short (+12bps to 4.21%), mid (+2bps to 7.73%) and long (+2bps to 9.78%) end of the bond yield curve.

The CBN floated N70 billion OMO auction Thursday to rollover maturities.

Chapel Hill Denham explained that in the interim, investors’ attention will be on the Debt Management Office (DMO) bond auction holding next week.

The DMO plans to issue up to N145 billion at the auction, split amongst JAN 2026 (N25bn), MAR 2035 (N40bn), JUL 2045 (N40bn) and MAR 2050 (N40bn) instruments.

The previous auction closed at 6.7%, 9.35%, 9.75% and 9.90% respectively, analysts at Chapel Hill explained.

In a related development, pressures eased in the parallel market today as the dollar to Naira ask rate appreciated by N3 or 0.65% to 462.

In the Investors and Exporters Window, the naira continues to trade within a tight band, and closed flat at 386.00.