60% Upside! FSDH Explains Why Investors Should Buy Airtel Stock

- Bullish on data, mobile money revenue growth

- Impressive performance despite dent from higher tax expense

- Revenue growth of 11.2%

- Profit before tax grew by 71.8%

- EBITDA climbed 17.3% despite inflationary pressures

- Net Income declines on higher tax expense

FSDH group has stated that Airtel Africa’s healthy fundamentals, improving debt position and sturdy growth story places it among its favoured buys.

However, analysts added a caveat, they explained that the telecom giant is highly illiquid.

In a note, FSDH confirmed that trading activities on Airtel Africa remains muted. This was attributed to limited volumes traded among the investing public.

At ₦298.90, Airtel Africa market capitalisation settled at ₦1.123 trillion on 3,758,151, 504 shares outstanding.

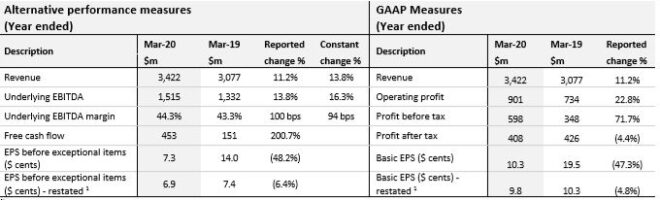

In 2020 result, the company’s revenue climbed higher by 11.2% to US$3.4 billion (- in constant currency terms – 13.8%) year on year from US$3.1 billion in 2019.

Meanwhile, the Q4 2020 standalone, the telecom company’s revenue growth printed at 15.1% year on year (in constant currency terms – 17.9%) to US$899 million from US$781 million in the comparable period in 2019.

Review of the financial shows that the growth in revenue was driven by broad based increase across key service units as voice revenue surged 2.9% to US$2 billion.

The breakdown of the telecom giants financial revealed that revenue from data service jerked up 36.1% to US$0.9 billion.

This happened just as mobile money revenue grew 32.9% to US$0.3 billion.

The growth in revenue was further underpinned by increase in Airtel Africa’s voice subscribers’ base.

It increased by 11.8% to 110.6 million subscribers while data subscriber base grew 15.9% to 34.8 million subscribers.

In addition, Mobile money subscribers increased 28.9% to 18.3 million subscribers.

Airtel Africa reported sub-inflationary growth in operating expenses, which climbed higher by 6.1% to US$1.9 billion in 2020 from US$1.8 billion in 2019.

The increase in operating expenses was driven by modest rise in network operating expenses by +12.5%, Access charges +9.0% and Spectrum usage charges went up +3.8%.

FDSH noted that devaluation of currencies in key countries where Airtel Africa operates have not fully crystallised.

“But we observed some evidence of pressure in Q4 2020 standalone result which showed an 11.0% increase in total operating expenses relative to Q4 2019.

“However, we note the increase remained below Q4 2020 revenue growth of 15.1%”, analysts at FSDH stated.

Against this backdrop, earnings before interest, tax, depreciation and amortisation (EBITDA) expanded 17.3% to US$1.5 billion in 2020, coming from US$1.3 billion in 2019.

However, EBITDA margin expanded 2.3 percentage points to 44.8%.

In addition, despite the 10.3% uptick in Depreciation & amortisation, operating profit printed a sturdy 22.8% increase to US$901 million in 2020 from US$734 million in 2019.

It was however noted that the telecom company record an increase in financial cost in the year under review.

It financial result shows that finance cost edges higher, this happened despite lower debt balance.

In what looks like a deliberate effort, Airtel Africa continued to improve its debt position as net debt to EBITDA printed in 2020.

This was the position as against 3.0x recorded at the end of 2019.

In absolute terms, the company’s total debt position declined by US$381 million at the end of 2020 with debt position now at 0.29x of total asset.

This translated to a decline when compare with 0.34x at the end of 2019.

Yet, finance cost still recorded an increase of 11.7% to US$440 million, this was driven by interest payment on other foreign currency denominated payables.

Meanwhile, finance income increased 109.4% to US$67 million, thus ensuring a marginal 3.0% increase in net finance cost to US$373 million in 2020 from US$362 million in 2019.

Consequently, the Telecom firm’s pre-tax profit expanded 71.8% year on year to US$598 million in 2020 from US$348 million in 2019.

However, tax expense dents impressive 2020 performance, analysts at FSDH remarked.

FSDH explained that the company recorded a tax expense of US$190 million in 2020 as against a tax credit of US$78 million in 2019.

This drove a 4.2% decline in net income to US$408 million in 2020 from US$426 million in 2019.

Then, Airtel Africa’s earnings per share printed at 10.32 cents for 2020, down from 19.53 cents in 2019.

This is due to higher number of outstanding shares following the Nigerian initial public offer (IPO) conclusion.

In 2020, the company recommended final dividend of 3 cents which brings total dividend for the year to 6 cents.

Cadbury delivers solid performance after restructuring

This implies a full year dividend yield of 6.8% and payout ratio of 58%.

Growth frontier remains data and mobile money:

“We remain very bullish on Airtel Africa’s revenue growth prospects which we believe would be spurred by data and mobile money revenue growth”, FSDH stated.

Analysts explained that Airtel Africa invested significantly in expansions projects and new initiatives to drive growth in these frontiers in 2020.

The firm also signals intentions to sustain further investment in bid to capture more value in the African telecoms market.

On data expansion projects, the company acquired more spectrum in Nigeria, Tanzania, Malawi, and Chad, FSDH highlighted.

For mobile money, the company signed strategic partnerships with Mastercard and Western Union.

This was in bid to enable Airtel mobile money subscribers make cross border payments along with several new product features.

More so, the company’s launch of Airtel TV earlier in 2019 continues to support revenue from other services subscriber base following introduction of improved content across Hollywood and Nollywood.

“Factoring in this growth potentials in our model, we project an 11.5% increase in revenue to US$3.8 billion, driven by accelerated growth in data and mobile money revenue growth.#

FSDH forecasted revenue from data to grow by 26.6% year on year to US$1.2 billion.

Also, it expects mobile money revenue to grow by 12.7% year on year to US$350 million.

“While we retain our confidence in management’s ability to keep costs under control despite high inflationary environment, we reckon that emerging risks of devaluation would pose mild pressures on cost efficiency.

“Thus, we forecast a faster than revenue growth in operating expenses, forecast to grow by 12.7% to print at US$2.1 billion”, FSDH stated.

However, the firm stated that it expects profit lines to remain sturdy with EBITDA, operating income and net income forecasted to grow by 10.6%, 21.3% and 26.4% respectively.

FSDH forecast that earnings per share will print at 12.94 cents in 2021; with dividend payment of 7.76 cents at a 60.0% payout ratio.

Highly illiquid but valuation and sturdy growth story informs BUY rating

Analysts explained that Airtel Africa’s healthy fundamentals, improving debt position and sturdy growth story places it among our favoured buys.

Post-IPO listing, the stock is down 8.2% driven largely by the bearish sentiments that has dominated the Nigerian equities market.

Thus, the telecommunication giant’s stock trades at 4.3x price to earnings multiple.

However, analysts at FSDH noted that trading activities on Airtel Africa remains very muted due to limited volumes traded among the investing public.

“Against this backdrop, we have had to factor in an illiquidity discount in pricing Airtel Africa stock.

“We have a target price of ₦477.60/s (or US$1.33/s) which implies a 59.79% upside to Friday’s closing price of ₦298.90/s and consequently place a BUY rating on the stock”, FSDH stated.

60% Upside! FSDH Explains Why Investors Should Buy Airtel Stock.

Buy Airtel