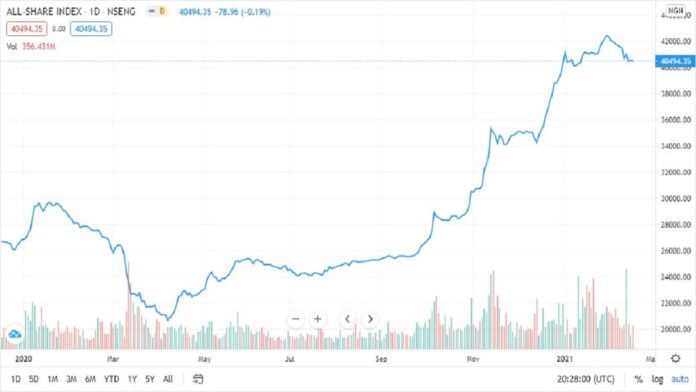

Stock Market Depreciates ₦41.3 Billion as Inflation Rate Rises

Stock market depreciates by ₦41.3 billion on Tuesday as Nigeria records another surge in headline inflation rate for January, 2021 from 15.75% reported in December.

Equities segment of the Nigerian Stock Exchange was a turn off for return seeking investors following uptrend in inflation rate record which kicked in at 16.47%.

The bearish sentiment in the domestic bourse resume after market opened the week on positive noted.

Thus, the benchmark index declined 19 basis points (bps) to 40,494.35 points on the back of sell-offs in STANBIC (-4.4%), NIGERIAN BREWERIES (-3.3%), and ZENITH (-0.6%).

Consequently, year to date return declined to 0.6% while market capitalisation plunged by ₦41.3 billion to settle at ₦21.2 trillion.

Market data shows activity level improved as volume and value traded advanced 72.8% and 166.3% respectively to 356.4 million units and ₦5.8 billion.

The most traded stocks by volume were GUARANTY (46.2 million units), FBNH (35.3 million units) and DANGSUGAR (26.8 million units).

Meanwhile GUARANTY (₦1.4 billion), SEPLAT (₦1.2 billion) and ZENITH (₦652.6 million) led by value.

Afrinvest said performance across sectors was mixed as 3 of 6 indices under its coverage closed lower.

The Insurance and Consumer Goods indices lost the most, down 1.5% and 0.5% respectively due to declines in WAPIC (-8.3%), CORNERST (-10.0%) and NIGERIAN BREWERIES (-3.3%).

Similarly, the Banking index inched lower by 0.3% as a result of losses in STANBIC (-4.4%) and ZENITH (-0.6%).

On the flip side, the Oil & Gas and Industrial Goods indices also appreciated 1.1% and 1bp respectively as SEPLAT (+0.8%) and CAP (+5.6%) ticked higher.

But the AFR-ICT index closed flat.

Investor sentiment as measured by market breadth weakened to 1.1x from the 2.3x recorded previously as 22 stocks gained against 20 losers.

Nigeria’s Inflation Rate Hits 15.75% over Increase in Food Prices

LEARNAFRICA (+9.3%), ARDOVA (+9.1%) and MULTIVERSE (+8.3%) were the top gainers.

On the other hand, CORNERST (-10.0%), UPDCREIT (-10.0%) and CHIPLC (-9.5%) were the top losers.

“We believe bargain hunting would boost the performance of the market this week as prices remain attractive”, Afrinvest said.

Stock Market Depreciates ₦41.3 Billion as Inflation Rate Rises