Remittance inflow to Nigeria, other African countries to shrink in 2020– Analysts

Analysts have projected a sizeable reduction in remittances flow into Nigeria in 2020 due to global economic lockdown and massive job losses.

According available data, total remittances inflow into African countries was about $70.7 billion, a strong growth from the base year.

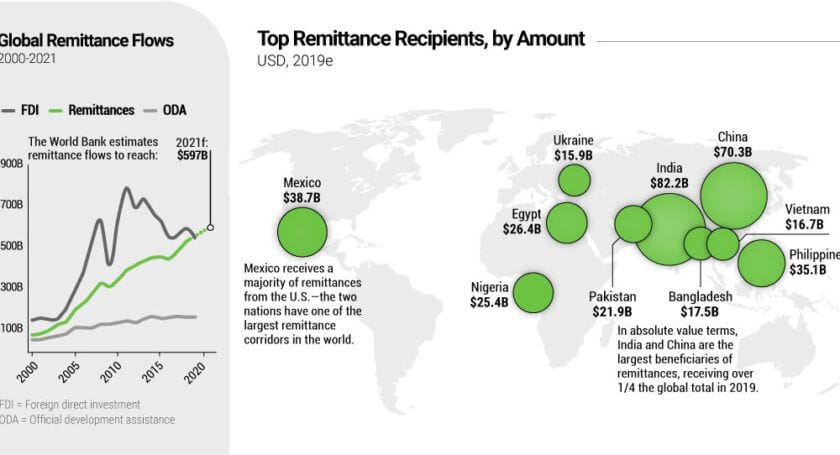

The World Bank predicted a 20% decline in global remittances due to the economic crisis induced by the Coronavirus pandemic.

Remittances could fall from $714 billion in 2019 to $572 billion in 2020, the World Bank report said.

The region reported an upsurge in flow as total remittances from African migrants abroad grew by 3.5% in 2019.

This translated to an average of 3% of African countries gross domestic products ( GDP) in the year.

Of the total remittance inflow into Africa, Nigeria was able to access $23.8 billion in 2019.

But, with the global economy slipping into recession, African migrants’ productive abilities have been curtailed on account of rising unemployment data.

Analysts explained that remittances remain largest source of external financing for many African countries.

Especially, countries with weak economic position and steep import bills.

In the year, both Egypt and Nigeria accounted for about 72% of the total remittance inflow into the continent in 2019.

The figure shows that total remittance inflow to Nigeria was $23.8 billion, thus ranked second after Egypt that benefited $26.8 billion.

With more than 37% flow into Egypt, Nigerian accounted for 34% of total remittances into African continent from migrants.

Meanwhile, World Bank report shows that remittances to Sub-Saharan Africa grew almost 10% to $46 billion in 2018, supported by strong economic conditions in high-income economies.

With COVID-19 on the streets, global economic size is expected to shrink, already many job losses have been recorded.

The struggle to get vaccine would alleviate pressure on productivity, research analysts at LSintelligence Associates said in an email.

The firm stated that major sources of remittances inflow into Nigeria are the United Kingdom, the United States, and Germany among others.

“Until these countries get off their knees, remittances into the continent may be halved at the next count”, analysts explained.

It would be recalled that the World Bank estimates that officially recorded annual remittance flows to low- and middle-income countries reached $529 billion in 2018.

This was an increase of 9.6% over the previous record of $483 billion in 2017.

The Bank had noted that global remittances, which include flows to high-income countries, reached $689 billion in 2018, up from $633 billion in 2017.

Read: Review-venture-capital-as-a-cure-for-Africans-funding-paralysis/

Remittance inflow to Nigeria, other African countries to shrink in 2020– Analysts