No Quick Fixes for Economic Challenge in Nigeria, Others –CBN Deputy

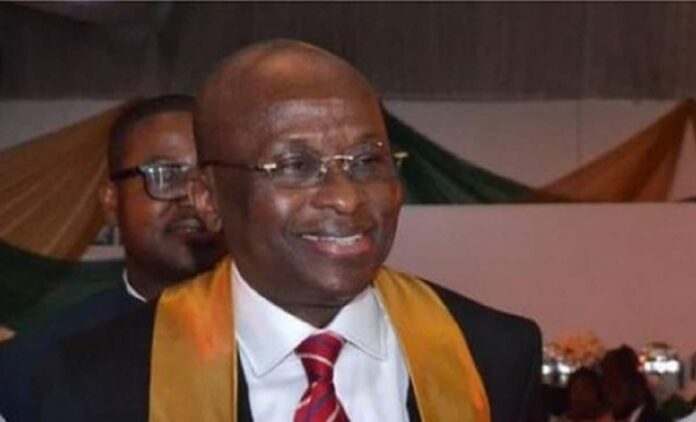

Adamu Edward, a member of the Monetary Committee (MPC) has hinted that there are no quick fixes for the economic challenge Nigeria and most countries currently face as a result of the covid-19 pandemic.

Adamu who is currently a Deputy Governor of the Central Bank of Nigeria (CBN) made this submission in September 2020 MPC communique with the personal statements of members.

The CBN Deputy Governor also recognised that fiscal space influence on the economy is limited due to revenue pressure. In his assessment, Adamu who became the Chairman for the Asset Management Corporation in December 2020 detailed that the global economy continues to be heavily challenged by the fallouts of the COVID-19 pandemic and commodity price volatility.

He stated that although economic activities have resumed in all parts of the world and are fast regaining momentum, the effects of the extreme measures deployed to counter COVID-19 would take a bit of time to dissipate fully.

“In fact, second quarter 2020 output figures for most countries showed higher magnitudes of contraction than expected”, he added.

Amidst high risks and uncertainty, he noted that the Organization for Economic Cooperation and Development (OECD) sees global growth contracting by about 4.5 per cent while the International Monetary Fund (IMF) now projects a 4.9 per cent contraction in 2020 with prospects of early recovery in 2021.

He explained that both institutions agree that building confidence will be crucial for an early and robust recovery. Already, global trade, one of the major casualties of COVID-19 lockdowns and movement restrictions, has commenced recovery – it grew from -12.3 per cent in April 2020 to 7.6 per cent in June 2020.

Adamu posited that businesses have remained broadly cautious of the possibility of a second-round pandemic even as production lines and supply chains are rapidly reopening. Meanwhile, commodity-exporting countries continue to face additional uncertainty arising from commodity price instability.

For Nigeria, Adamu said low and volatile oil prices continue to be a major cause for concern, just as it is for most OPEC Member Countries. Across the globe, public budgets have been thrown into massive deficits and pressure on monetary authorities for accommodation has intensified, especially in emerging markets and developing economies (EMDEs).

According to Adamu, global inflation has remained muted, reflecting mainly, below-target-inflation in advanced economies especially, which has made it more convenient for central banks in those economies to sustain massive injections of liquidity.

“In the group of emerging market and developing economies, inflation pressures have tended to grow largely on account of depreciating exchange rates and rising energy costs in some cases.

“Nonetheless, most central banks in this clime, including the Central Bank of Nigeria (CBN), have continued to support demand and confidence by preventing a tightening of financial conditions.

“It must be emphasized that the current domestic economic slowdown is not the regular boom-bust cycle of activity; in fact, the Nigerian economy was barely recovering from the 2016 slowdown when COVID-19 struck.

“The consequential lockdown and movement restrictions suddenly halted most economic activities.

“Yet, even as an activity should logically resume in the affected sectors as the lockdowns and movement restrictions are eased, there is no gainsaying that some kind of fiscal push will be required”, CBN’s Deputy Governor added.

However, owing to the narrow fiscal space at the present, Adamu explained that the greater burden of providing that critically needed support has to be borne by the CBN, very much like most monetary authorities have done and are still doing.

Adamu stated in his submission that there are preliminary indications that the development finance interventions by the Bank are having the desired effect and should, therefore, be sustained and possibly deepened in the short- to medium-term.

“Nevertheless, we must admit that in some ways COVID -19 has significantly altered the way we live and conduct economic activity/ business and some of its consequences might remain for a while.

“There will be lasting consequences for employment, production cost and how economic agents engage resources, even under the best circumstances of early vaccine plus a cure.

“To the extent that inflation and exchange rate pressures are part of the domestic policy challenge today, I felt the need to exercise some caution in terms of the deployment of core monetary instruments at the September 2020 meeting of the Monetary Policy Committee (MPC)”, he explained.

There is no doubt, ensuring adequate liquidity in the system continues to be vital for output recovery; as such, the effort of the CBN in this respect needs to be complemented by positive actions by banks.

“I, therefore, saw clearly the need to expand the interest rate corridor as part of measures to reduce the incentives of banks to dump their excess reserves at the CBN’s Standing Deposit Facility (SDF).

“I was, however, less inclined to deploy the monetary policy lever, full throttle, at the September 2020 meeting owing to some considerations”, Adamu stated.

First, headline (year-on-year) inflation has maintained an upward trend in over 10 months. It rose to 13.2 per cent in August 2020, driven mainly by food inflation, which rose to 16.0 per cent. Juxtaposed on rising month-on-month inflation and a worsening outlook for core inflation, a change in direction of headline inflation doesn’t seem likely in the next 2 to 3 months.

Although much of the current inflationary pressures may be attributed to non-monetary factors, non-targeted monetary expansion may not be very helpful either, he explained.

Adamu added that it could, in fact, become problematic down the road. Second, he believed that several policy measures which the CBN had implemented prior to, and since the outbreak of COVID-19, have continued to have a tremendous effect.

In particular, the Differentiated Cash Reserves Requirement (DCRR) and the minimum Loan-to-Deposit Ratio (LDR), have ensured a significant stream of credit to the real economy. As of end-August 2020, aggregate bank credit had risen by about N3.7 trillion relative to its level in May 2019, when the LDR policy was introduced.

The outlook for credit to the economy remains positive given that these policies are still in place and, importantly, that the banking industry continues to be resilient. In fact, the industry’s non-performing loans ratio declined in August 2020 to 6.1 per cent from 6.4 per cent in July, while the capital adequacy ratio (CAR) rose to 15.3 per cent from 14.6 per cent in July.

He explained also that the demand pressure in the foreign exchange market has remained elevated in the face of declining accretion to external reserves and declining private inflow.

“Related to this is the pressure on the balance of payments. The current account deficit could grow as the economy reopens and imports of raw materials and the critically needed medical consumables and equipment resume.

“Beside legitimate sources of foreign exchange demand, speculation and other frivolous demands have contributed to sustaining pressure on the naira exchange rate.

“In all instances, the demand for foreign exchange thrives on naira liquidity. It is therefore pertinent to properly guide the flow of liquidity to those activities/sectors that promote growth and employment using instruments that can target productive activities, rather than those that ease credit creation generally”, he stated.

Adamu then explained that he has no doubt that the surest path to early recovery would entail, amongst others, significant financial support to the health system to enable it to cope with the COVID pandemic.

He stated further that the CBN is already leading the way with dedicated interventions in the health sector, which may be ramped up with the collaboration of the private sector and government at all levels.

“I should emphasize that there are no quick fixes for the economic challenge Nigeria and most countries currently face.

“In climes where the problem is limited to slowing output and employment, the pathways are much clearer.

“However, in a more complex situation such as Nigeria faces with rising inflation and weak external position, I would rather lean more towards instruments that target the real economy such as the Bank’s development finance interventions, LDR and DCRR, which have all proved to be reliable and quicker in effect.

“I am fairly optimistic, given the rollback of lockdowns and movement restrictions, the gradual reopening of the economy and the broad-based activity support by the CBN and the government’s Economic Sustainability Plan (ESP) that real output growth in Q3 and Q4 2020 would be better than recorded in Q2 2020”, Adamu said.

Against the foregoing, Adamu voted to retain all other policy parameters apart from the interest rate corridor while urging the Federal Government to speed up implementation of the ESP and the Bank to sustain its intervention actions in support of the economic activity.

Meanwhile, Adamu said: “Let me emphasize that the challenge posed by rising food prices demands action beyond monetary policy and/or catalytic interventions in agriculture.

“As I have noted in some of my previous statements, farm insecurity and food distribution bottlenecks need to be addressed holistically to ease food prices across the country on a sustainable basis”.

Read Also: CBN to Commence Phase Implementation of Basel III Accord

No Quick Fixes for Economic Challenge in Nigeria, Others –CBN Deputy