Nigeria’s Debt Market Records Week Long Strong Sell-offs

Nigeria’s debt market records all week long strong sell-offs amidst sustained rally in the equities market rally recorded this week.

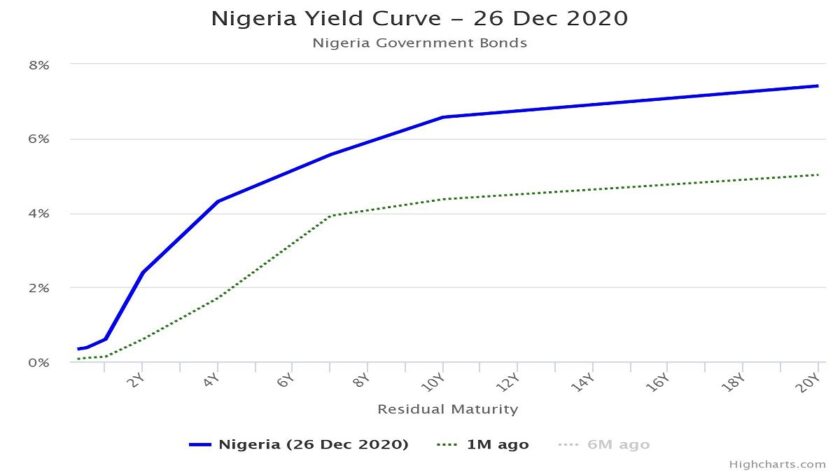

In a four-day trading week, activities in the fixed Income market remained bearish from the prior week to settle the average yield across the market at 2.28% from 2.07% week on week.

Investors continued booking profit in the Bond and open market operations (OMO) markets while the treasury-bill market closed marginally positive.

Greenwich Trust said while investors sold off holdings at the belly of the curve, persistent bids at the head and tail of the curve spurred the T-bill market into the light.

Thereby, analysts at Greenwich said average yield in the T-bill market plunged by 2bps week on week to settle at 0.38% from 0.40%.

On the flip side, the OMO-bill market was largely a sellers’ market following chunk of offers across the curve save for the 16 FEB 2021, 16 MAR 2021 and 30 MAR 2021 papers.

Consequently, average yield in the OMO-bill market spiked by 8 basis points (bps) to 0.54% from 0.47%.

With the system buoyed with an estimated ₦750 billion in liquidity, Money Market rates softened further into single digits, bolstered by inflows from maturing OMO-bills with no offsetting outflows.

Thus, the Overnight and Open Buy Back rates closed at 0.58% and 0.43% from 4.5% and 4.5% respectively in the prior week.

Investors continue to book profit in the Bond Market all through the week, as investors sold off positions in order to close their books on a high note as the year wraps up.

Consequently, average bond yield steeped northwards by 56bps to 5.91% from 5.34% at the close of trading in the prior week.

In the FX market, the Naira strengthened at the Parallel market following increased supply from remittances in light of policy reforms recently announced by the Apex Bank.

The Naira closed at ₦465 to dollar from ₦477 to a unit in the prior week.

Read Also: Bond Market Investors Raise Position on Short-term Instruments

Further afield, turnover eased by 7.0% week on week in the Investors & Exporters Window (I&EW) to a weekly average of US$145.2mn compare to US$157.2mn in the prior week.

While the Naira strengthened in the I&E Window to close at ₦392.0/US$ as against ₦394.0/US$ in the prior week.

“Forging ahead to the new week, we expect the market to remain lukewarm and investors will remain averse as market players begin to close their trading books for the year”, Greenwich said.

Nigeria’s Debt Market Records Week Long Strong Sell-offs