Nigerian T-Bills Discount Rates Closed Flat as Naira Gains

Discount rates on Nigerian Treasury-Bills and Open Market Operations bills closed flat Wednesday as financial system liquidity opened higher at N353.4 billion, up from N328.2 billion yesterday.

Notwithstanding, funding pressures increased, as a result of primary market auctions (OMO and NTB). As a result, the Open Buy Back (OBB) and Overnight (O/N) rates increased to 8.25% and 9.25% from 6.33% and 7.17% respectively.

“We expect funding pressures to increase in subsequent sessions”, analysts at Chapel Hill Denham said in a market report.

Overall, the Nigerian fixed income market continued to trade largely flattish in view of the uncertainty in monetary policy and ongoing primary market auctions.

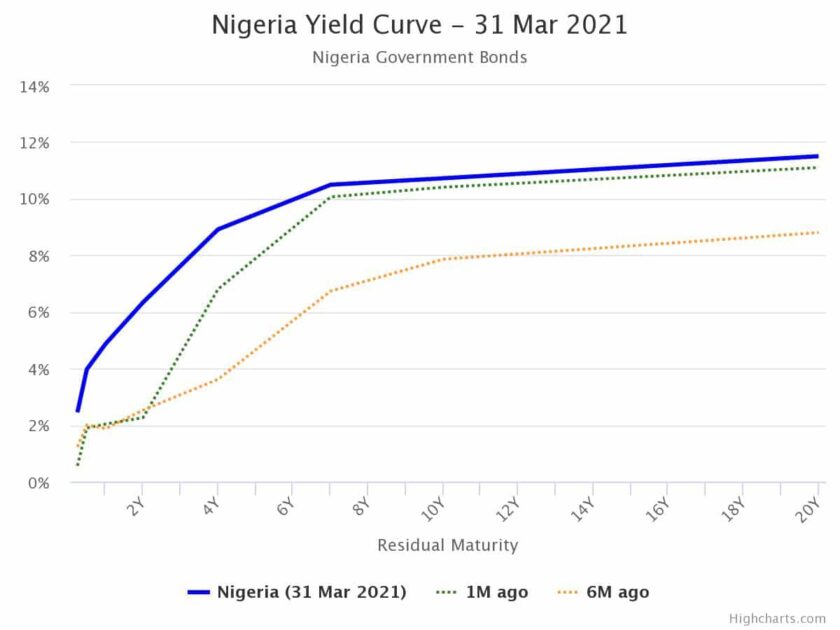

Specifically, in the bills segment, discount rates on the T-Bills and OMO benchmark curves closed flat at 3.82% and 6.10% respectively. Similarly, bonds closed largely flat, with the benchmark yield curve unchanged at an average of 10.42%.

Chapel Hill Denham said given the hawkish tilt of the MPC at the committee meeting which held last week, the firm expects the duration apathy in the bond market to persist over the near term.

Meanwhile Naira strengthened further against the United States dollar at the Investors and Exporters Window, albeit marginally by 8 basis points or 33 kobo to 408.67. In the parallel market, the Naira traded flat against the greenback to 486.00.

Foreign exchange rate remained unchanged in the official and Secondary Market Intervention Sale (SMIS) segments at 379.00 and 380.69 respectively. External reserves maintained the recent upward trend, strengthening marginally by 0.6% week on week to US$34.8bn on March 30th 2021.

Today, Nigeria’s equity benchmark index extended its losses for the second straight session, following losses across some heavyweight banking names.

Notably, the NSE All-Share Index dipped by another 57bps to 39,045.13pts. Against that backdrop, year to date loss rose to 3.04%, while the market capitalisation declined to N20.429 trillion.

On today’s price list, LINKASSURE (+10.00% to N0.66), MEYER (+9.76% to N0.45), and PRES-TIGE (+9.76% to N0.45) were today’s top gaining stocks. On the flip side, DAARCOMM (-8.70% to N0.21), WEMABANK (-8.06% to N0.57), and UPL (-7.76% to N1.07) were today’s top losers.

Chapel Hill Denham said performance across its coverage universe was mixed, albeit with a bullish bias. Precisely, only 2 of 5 of under its coverage indices closed in the red terrain.

The NSE banking and NSE industrial goods indices dipped by 84bp and 3bps, respectively. The foregoing masked the gains recorded across the NSE insurance, NSE consumer goods, and NSE oil & gas, all of which rose by 222bps, 39bps, and 2bps, respectively.

Read Also: Discount Rates on T-Bills Eased as Fixed Income Market Trades Soft

The market’s activity was broadly mixed, with the total volume rising by 3.29% to 347 million, while the total value traded also declined by 14.24% to N2.803 billion.

Today’s most traded stocks by volume were WEMABANK (94.05 million units), UBN (78.91 million units), and ZENITHBANK (22.14 million units).

On the other hand, the top traded stocks by value were SEPLAT (N0.520 billion), ZENITHBANK (0.500 billion), and UBN (0.418 billion). Elsewhere, the Chapel Hill Denham’s Paramount Equity Fund (PEF) and the Women Investment Fund (WIF) closed flat.

Nigerian T-Bills Discount Rates Closed Flat as Naira Gains