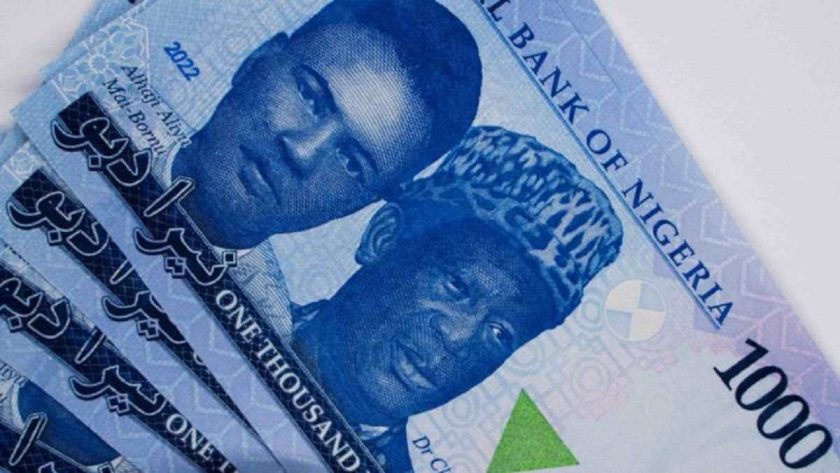

Naira Mixed as FX Interventions Hit $1 Billion

The Nigerian Naira mixed across the foreign exchange (FX) markets as the monetary authority’s US dollar intervention sales crossed $1 billion in March while data showed external reserves at $38.303 billion.

On Tuesday, Naira declined to N1532 against the US dollar despite sequence of FX interventions in the foreign exchange market. The local currency lost N1.20 to close at N1,532.39 in the official market.

In the first two trading sessions this week, the Central Bank of Nigeria (CBN) injected US dollar into the official market, while authorised dealer banks also maintained $25,000 weekly FX sales to Bureau de Change (BDCs) operators.

The spot fx rate at the parallel market was relatively stable at N1,570.00 per greenback on Tuesday. To keep FX inflows in the official window strong, the CBN injected $41.60 million, pushing total sales for the month beyond $1 billion, investment firm TrustBanc Financial Group Limited told investors in a note.

On Tuesday, the CBN sold $27.9 million at rates between N1,528.31 and N1,534, according to AIICO Capital Limited, added that the USD/NGN pair fluctuated between N1,528.31 and N1,537.00, ultimately closing at N1,532.39.

In the global commodity market, oil prices climbed for a fifth straight day on Tuesday, driven by expectations of tighter global supply following U.S. tariffs on countries purchasing Venezuelan crude.

However, gains were capped by OPEC+ plans to proceed with a production increase in May. Brent crude rose 46 cents, or 0.6%, to $73.46 per barrel by 10:23 GMT, while WTI gained 46 cents, or 0.7%, to $69.57.

Meanwhile, gold prices edged higher as safe-haven demand grew amid uncertainty over U.S. President Donald Trump’s upcoming tariff policies and potential inflationary pressures. Spot gold rose 0.3% to $3,021.39 an ounce, with U.S. gold futures up 0.4% at $3,026.20. #Naira Mixed as FX Interventions Hit $1 Billion FCMB Climbs as Investors Await Audited Results