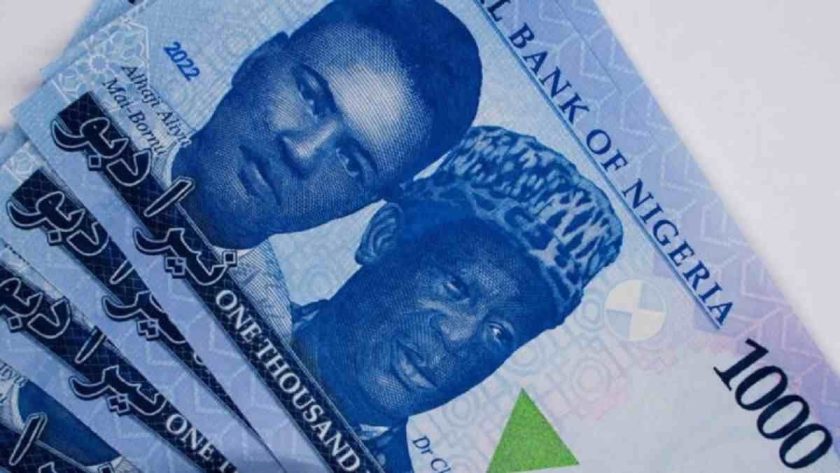

Naira Falls to N1548 Against Dollar, Foreign Reserves Bump

The naira fell slightly against the US dollar at the Central Bank of Nigeria (CBN) foreign exchange window due to increased FX demand logged by companies. The official market remained adequately liquid, with the exchange rate largely stable on Monday.

The USD/NGN pair traded within a range of $/₦1,545.00 to $/₦1,551.00, according to analysts’ FX updates. At the end of the day, the naira slipped by 7 bps to close at $/₦1,548.5237 amidst declining foreign reserves.

CBN’s data revealed that gross external reserves printed lower at $37.663 billion on Friday. Citing FX intervention support, analysts said the naira is projected to maintain its current trading range, provided no unforeseen disruptions occur.

Elsewhere, Oil prices plunged over 6% on Monday following Iran’s missile strike on a U.S. military base in Qatar, launched in retaliation for U.S. attacks on Iranian nuclear facilities over the weekend.

Despite the aggression, Iran did not interfere with oil and gas tanker movement through the Strait of Hormuz, helping limit broader market panic. For now, oil supplies remain unaffected as the conflict focuses on military targets rather than energy infrastructure, according to media reports.

Brent crude futures dropped $4.90, or 6.3%, to $72.19 a barrel, while U.S. West Texas Intermediate (WTI) crude fell $4.60, or 6.2%, to $69.23. Due to continued demand for safe haven, gold prices climbed as investors sought safety amid rising Middle East tensions, with spot gold up 0.4% at $3,382.42 an ounce.

Prices may ease if tensions don’t escalate further, but investors still debate how much risk premium is justified given unchanged supply. #Naira Falls to N1548 Against Dollar, Foreign Reserves Bump Ghana Drives Intra-African Trade Under AfCFTA