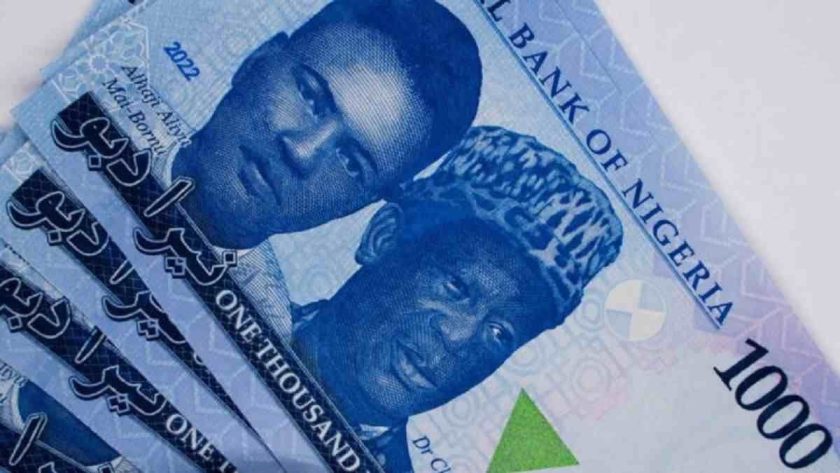

Naira: CBN NFEM Rate Falls on FX Liquidity Shortfall

The naira exchange rate fell at the Nigeria foreign exchange market official platform of the Central Bank to close at N1608.63 amidst relatively FX intervention slowdown.

The Central Bank of Nigeria (CBN) aggressive fx intervention has begun to ease in May as financial market continues to stabilised after riotous sell down in naira assets in the recent past months.

Official FX spot rate hit as high as N1614 in the official window and traded low at N1608 per dollar on Thursday.

FX liquidity supply in the interbank market—primarily driven by the central bank’s intervention and supplemented by exporter inflows— helped stabilize trading conditions.

This reduce exchange rate volatility to a level not outside the targeted range by the Apex Bank.

Eventually, the naira slip by 6 to close at N1,609.6357. Analysts said in the near term, the CBN’s continued market interventions are expected to keep the currency trading within its present range while external reserves growth will aid the fx market back up.

According to data from the CBN, Nigeria’s gross external reserves has been boosted to $38.096 billion after seventh inflows from sources in two weeks. The foreign reserves picked up from $37.797 billion in April 25, ended the same month at $37.993 billion.

In May, gross balance in external reserves has surged by over $100 million to the current level following successive OMO actions.

Elsewhere, oil prices climbed more than 2% on Thursday, driven by optimism over potential progress in U.S.-China trade talks, as both countries remain key global oil consumers.

Brent crude futures rose $1.43, or 2.3%, to $62.55 a barrel, while U.S. West Texas Intermediate (WTI) crude gained $1.50, or 2.6%, to $59.57.

Meanwhile, gold prices continued to decline, dropping nearly 2%, after President Donald Trump announced a trade agreement with the United Kingdom, raising expectations of more deals globally.

Spot gold fell 1.9% to $3,301.15 an ounce while U.S. gold futures were down 2.5% at $3,306, extending losses as investor sentiment shifted toward riskier assets.

Analysts said crude price volatility is expected to persist, driven by OPEC+’s accelerated supply ramp-up and lingering U.S. policy unpredictability Lagos, BoI to Sign MoU to Improve SMEs Access to Finance