Fiscal, Monetary authorities converging policy to reduce debt cost

There are indications that both monetary and fiscal authorities are channeling policies towards achieving minimum borrowing cost as FG reiterates stance to borrow to finance 2019 budget.

This week, the monetary policy committee (MPC) of the Central Bank of Nigeria (CBN) slashed benchmark interest rate to 13.5%, the move which caught many investment banking firms and analysts unaware.

A day after, the fiscal authorities repeat the government decision to access funds from both home and abroad on the back of deficit budget financing.

Ahead of the meeting, analysts had projected that MPC would maintain status quo so as to consolidate on the growing macroeconomic indices and ensure stability in the market.

On Wednesday however, the Federal Government reveal plan to tap concessionary long-term loans to finance its 2019 budget in addition to borrowing at home, Finance Minister Zainab Ahmed said.

“We intend to fund the 2019 budget through borrowing locally and internationally with a spread of 50:50. Our focus is on concessionary long-term loans,” said a National Assembly tweet quoting the finance minister.

The reduction in MPR will give some respite to cost of borrowing and loads on FG revenue would be reduced.

“In our earlier Pre-MPC report, we noted that “we expected the MPC to hold all policy rates at current levels in next week’s meeting, although the case for monetary easing has become compelling”.

However, our expectations were off as the Committee favoured a rate reduction”, Afrinvest said.

In the firm review, it observed that since the July 2016 tweak in MPR and the subsequent use of short-term market rates to anchor monetary policy, the analysts at the firm have continuously expressed their views on the redundancy of the benchmark rate.

“We think the MPC is moving back to convention and aligning policy rate to market rates.

Currently, the average short-term discount rate settled at 12.7%, which implying an average yield of 13.6%), which aligns with the new MPR at 13.5%”, Afrinvest remarked.

FG has borrowed abroad and at home over the past three years to help to finance its budgets and to fund infrastructure projects but debt servicing cost is also rising.

Ahmed said there were challenges generating revenue but that the 2018 budget has performed well. She said the government had put in place strategies on how to finance the 2019 budget of 8.83 trillion naira.

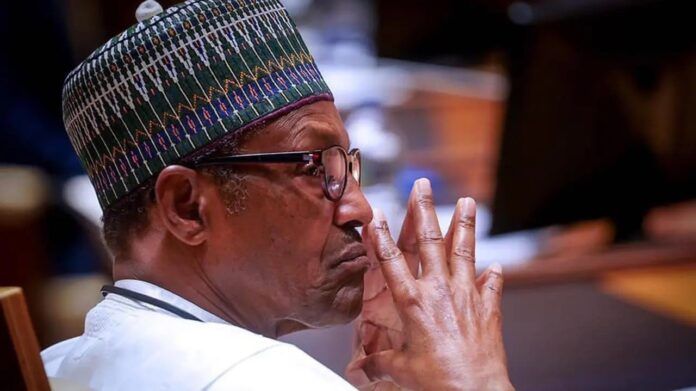

Budgets under President Muhammadu Buhari, who starts a second term in May, have been Nigeria’s largest ever but has failed to provide the type of capital spending needed to improve infrastructure due to funding issues.

The government has been seeking to boost revenue after it emerged from a 2016 recession two years ago.

The CBN said GDP growth could pick up in the first quarter, buoyed by election spending and this year’s government budget, to reach 3 percent from 1.9 percent last year.

On fiscal front, FG said that it will prioritize borrowing from concessional lenders such as the World Bank and African Development Bank as it looks to rein in interest payments.

“If you were to ask me if we’re going to issue Eurobonds this year, I’d say we’ll explore all the options,” Patience Oniha, Head of the Debt Management Office, said in an interview.

“Our preferred option is to explore concessional sources. One of our major objectives is to reduce debt-service costs.” She added

Nigeria’s 2019 budget presented by President Muhammadu Buhari in December and yet to be approved by lawmakers, as market envisaged that the government will be issuing about 1.65 trillion naira ($4.6 Billion) of new debt, half of which would be in foreign currency.

Africa’s biggest oil producer has mostly used the Eurobond market for its external funding in recent years, rather than concessional lenders.

It sold $5.4 billion of bonds last year and $4.8 billion in 2017, making it Africa’s most prolific issuer in that period after Egypt.

Bank of America said in a research note this month noted that Nigeria would probably print another $3 billion of securities in the second half of 2019.

Its Eurobonds have returned 14.4 percent since the end of 2018, second only to Kenya among sovereigns in emerging markets, According To Bloomberg Indexes.

While Nigeria’s ratio of debt-to-gross-domestic product is low relative to other governments at about 25 percent, its small tax base means interest costs as a proportion of revenue are high.

The federal government’s interest payments-to-revenue more than doubled to 60 percent last year from 27 percent in 2014.

According to the International Monetary Fund; the figure is on course to rise to 82 percent by 2022, which the Washington-based lender says is unsustainable.”

Oniha reiterated that while the government is “always speaking” with the World Bank and African Development Bank, it won’t borrow from the IMF.

“We’ve made It clear we’re not in the situation where we need IMF support,” She Said.

The DMO is continuing with a plan to increase its proportion of foreign liabilities to 40 percent to reduce funding costs. The ratio is probably somewhere between 30 percent and 40 percent following the sale of $2.9 billion of bonds in November, Oniha Said.

Yields on Nigerian Eurobonds average 7.3 percent, half that for Naira Bonds, According to data compiled by Bloomberg and JPMorgan Chase & co.

“The debt service-to-revenue ratio is rising,” she said. “We’re not sitting and saying we’re comfortable. Part of the reason for borrowing externally is to borrow at 8 percent rather than 18 percent.

It’s cheaper and we’re assuming the Naira will be stable.

Fiscal, Monetary authorities converging policy to reduce debt cost