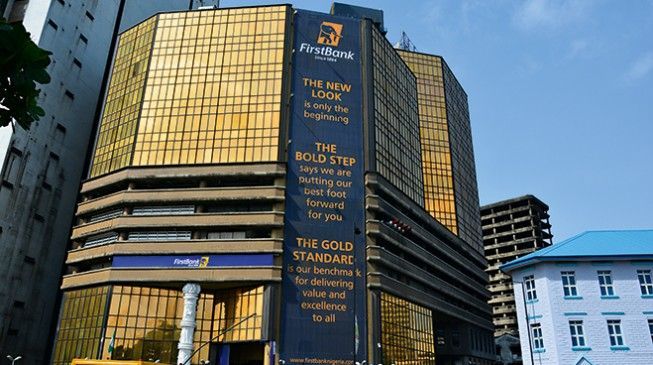

FBNH: Analysts Raise Price Target on Account of Solid Balance Sheet

First Bank of Nigeria Holdings Plc traded at ₦5.30 on Wednesday, though analysts have estimated price target that is more than double this market price.

After its successful balance sheet repair program, FBNH has come out stronger. Investors value the brand at N₦186.655 billion on the Nigerian Stock Exchange.

Given its focus on improving assets quality, its non-performing loans improved 7 basis points to 9.2% in the first quarter of 2020.

Vetiva Capital Limited set price target of ₦11.37 for FBNH, which translates to 114% upside when compare to its market price.

The lender offers highest upside potential among top five banks due to lower valuation.

Vetiva Capital said it does not expect the bank to place much focus on meeting loans to deposit ratio requirement in the near term.

In the first quarter of 2020, FBNH recorded a 9% year on year growth in gross earnings to ₦159.7 billion.

This came despite 6% year on year decrease in interest income due to weaker yield environment in Q1.

Vetiva’s analyst stated that FBNH’s Q1 earnings beat came as a result of a 57% jump in non-interest income to ₦54.8 billion.

This was however as result of 748% spike in income from sales of investment securities during the quarter.

Plus, mild 12% year on year gain in fees and commission.

MarketForces had reported lender’s increased investment in technologies aiming to boost its retail footprint, following a positive drive to lift non-interest related businesses.

Added to margin supportive drives, the bank reported a marginal increase in operating expenses to ₦76.6 billion.

This happened at the time when inflation rate is racing speedily which indicates cost efficiency in the period.

Furthermore, due to cleaner balance sheet, the lender’s loan loss provision decreased by 30% year on year to ₦9.7 billion.

Explaining the impact of the management strategic moves, Vetiva said that the decline in loan loss provision and tamed operating expenses indicate that the bank strategy of improving efficiency and managing risks is yielding results.

Vetiva’s analyst expects that the onset of COVID-19 pandemic would further test management’s strategy in the coming quarters.

The earnings beat resulted to a strong uptick down the line as profit line spiked in Q1 2020 compare to base period in 2019.

Nigerian Breweries Shares Rally More than 45% in 4 days

FBNH’s bottom line enjoyed double digit swings, beat analysts’ consensus estimates as profit after tax lifted 47% to ₦23.1 billion.

Vetiva capital confirmed that the lender’s profit level surpassed its ₦20.6 billion estimate for the period.

Vetiva said Q1 2020 profit after tax recorded was highest since first quarter of 2013 when FBNH reported ₦24.7 billion.

This gave the bank return on average equity of 15.3% up from 12.4% in financial year 2019.

On LDR, Vetiva Capital said it expects apex bank to grant some leeway with regards to the regulation, while it continues to use CRR debit as form of liquidity control.

Ultimately, Vetiva said the current economic climate does not favour further loan growth, with contractions likely to come in subsequent quarters.

Default rate is also likely to increase, the firm stated.

Vetiva projects profit after tax of ₦74.5 billion for 2020, this translates to return on average equity of 10.6% and earnings per share of ₦2.07 for the year.