Debt Market Investors Wait on Sideline in Anticipation of CBN Special Bills

Trade settled flat at the Nigerian Treasury Bills (NTB) market amid record-low yields, as investors wait on the sidelines in anticipation of Central Bank of Nigeria’s Special Bills.

The apex bank in a circular hinted plan to release excess cash reserve ratio requirement (CRR) of banks to boost system liquidity and support credit creation.

As a result, analysts at Greenwich Merchant Bank stated that the subdued sentiment kept the market unchanged for the third session this week at 0.1% average yield.

Following the same pattern, the financial system remains largely buoyant, opening the day slightly higher at N635 billion from N628bn previously.

Thus, funding rates remain generally benign.

Notably, the Open Buy Back (OBB) rate compressed by 8bps to 0.67%, while the Overnight (OVN) rate was unchanged at 1.00%.

“We believe supportive system liquidity will continue to keep funding pressure in check through the rest of the week”, Chapel Hill Denham said.

As noted, debt market investors sustained apathy towards the secondary NTB market, as discount rates on benchmark NTBs remained flat at 0.10%.

In the same vein, the average rates were largely unchanged at the secondary OMO segment of the market to close at 0.11%.

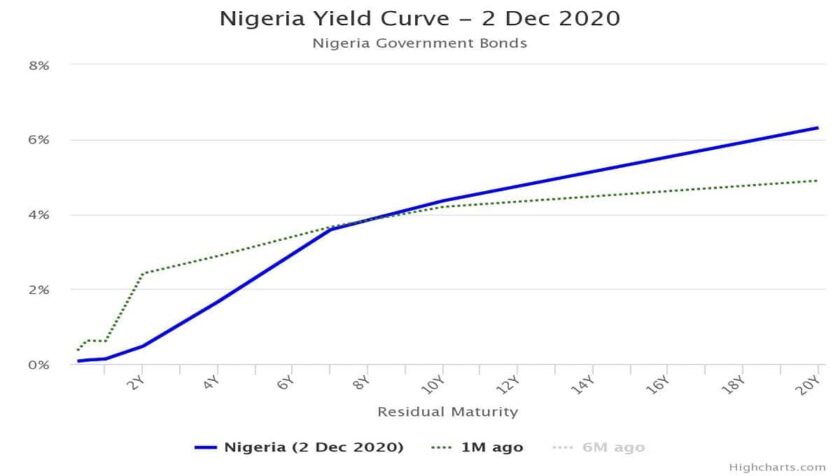

Meanwhile, in the bond segment, the market traded slightly bearish today, driven mostly by investors’ upward repricing of long-dated instruments.

Precisely, yields expanded by as much as 11bp on average across the benchmark curve to close at 4.09%.

This was driven mostly by the sell-offs in the short (142bps to 1.38%) and long (+25bps to 6.01%) end of the curve, both of which masked interest in the mid-day to maturity (-4bps to 4.28%).

The nation’s Debt Management Office , DMO, released Q1-21 NTB auction calendar, which shows plans to roll over 100% of maturing bills.

Read Also: Unattractive yields: investors wait on sideline

The breakdown of the auction shows that DMO intends to issue N850.42bn in total, split across 91-day (N76.8bn), 182-day (N176.9bn), and 364-day (N596.7bn) tenors.

While the DMO is looking set to mop up all maturing NTB over Q1-21, analysts at Chapel Hill Denham express view that OMO maturities of more than N4.5tr in the same period will keep the system awash with liquidity.

In the currency market, the exchange rates were unchanged at N379.00 and N380.69 at the official and secondary market intervention sales windows, respectively.

However, the Naira sustained its weaknesses at the I&E window, depreciating markedly by N1.00 or 25bps to N395.00.

Elsewhere, pressures on the Naira further eased by N5.00 or 1.03% to close at N485.00 in the parallel market.

“In our view, the recent episode of naira appreciation in the parallel market is not un-connected with the newly issued CBN’s circular, with the Apex bank now seemingly allowing greater flexibility with Domiciliary accounts, a move targeted at encouraging remittances.

“Pertinently, unlike in the recent past, the Bank stated, based on the circular published today, that beneficiaries of diaspora remittances through IMTOs can now receive such inflows in USD, either in cash or ordinary domiciliary account”, Chapel Hill Denham stated.