Nigeria Turns Down Bids over Excess Demand for Local Bonds

The Debt Management Office, DMO, recorded excess demand for Federal Government of Nigerian (FGN) bonds at its monthly primary market auction on Monday. Nigeria’s debt agency conducted a primary market auction on Monday where it offered N350 billion worth of local bonds to investors.

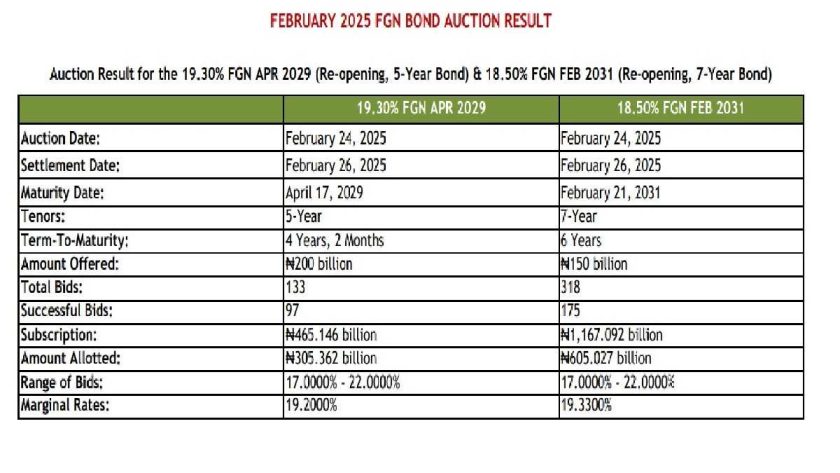

The amount DMO sought to raise from 5-year and 7-year bonds were N200 billion and N150 billion following announcement of cancellation of N100 billion worth of 10-Year bonds.

The auction results revealed that investors staked more than N1.632 trillion on the amount offer amidst increasing appetite for the naira assets. The 5-Year FGN bonds received a total subscription of ₦465.146 billion from investors. Of the total bids, the DMO allotted ₦305.362 billion to investors, meeting 97 out of 133 bids it received.

For the 7-Year bonds, DMO offered to raise N150 billion but subscription came heavier as investors continue to capitalise on real returns. While investors’ subscription came at ₦1, 167.092 billion, the DMO only sold ₦605.027 billion – success bids was 175 out of 318 pushed forward.

Successful bids for the 19.30% FGN APR 2029 (Re-opening, 5-Year Bond) & 18.50% FGN FEB 2031 (Re-opening, 7-Year Bond) were allotted at the Marginal Rates of 19.20% and 19.33%, respectively.

However, the original coupon rates of 19.30% for the 19.30% FGN APR 2029 & 18.50% for the 18.50% FGN FEB 2031 will be maintained, DMO said. #Nigeria Turns Down Bids over Excess Demand for Local Bonds ECOWAS Issues Deadline to Bukina Faso, Mali, Niger