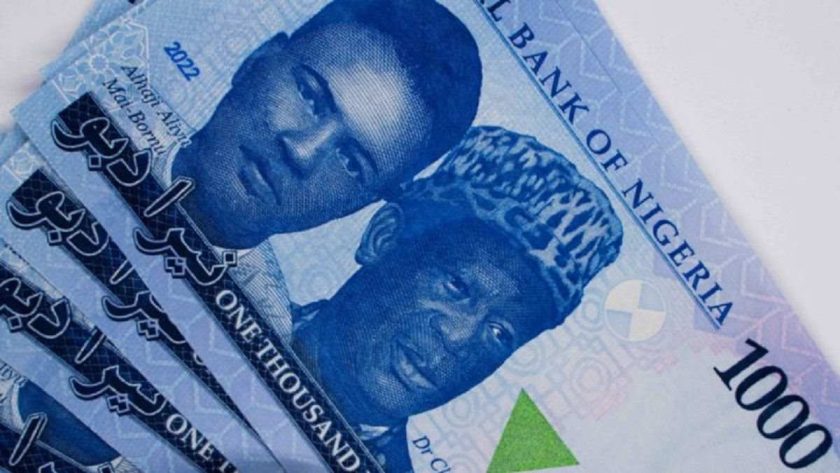

Naira Extends Rally as IOCs, FPIs, CBN Boost FX Liquidity

With rapid daily gain, the naira extends its rally in the currency market as a flood of US dollar credits boosted liquidity level in the official window on Thursday. According to spot data from the FMDQ platform, the naira appreciated by 1.7% to N1,458.95 per US dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM).

The local currency strengthened due to strong FX inflows from tripartite sources. The market recorded inflows from international oil companies (IOCs) and foreign portfolio investors (FPIs) ahead of the OMO auction and FX intervention sales conducted by the Central Bank of Nigeria (CBN), according to analysts notes.

The increased US dollar liquidity driven by the activities of the key market participants on the supply side tempered demand pressure. The Nigerian FX market started the week with an increase in US dollar inflows from exporters. Last week, FX inflows in Nigeria’s autonomous market increased by 125%.

In a note, AIICO Capital Limited told investors that most of the transactions conducted today were conducted within the range of $/₦1,490 to $/₦1,517.00. Broadstreet analysts who spoke with MarketForces Africa attributed the exchange rate improvement to a heightened influx of US dollar, bolstered by renewed investors’ confidence.

This week, the Apex Bank introduced FX code to increase transparency in the currency market and warned authorised dealer banks about grave consequences over potential breaches and infractions.

Elsewhere, oil prices remained relatively stable as investors monitored the tariff threats posed by U.S. President Donald Trump against Mexico and Canada, which are the largest suppliers of crude oil to the United States.

Brent crude was priced at about $76.48 per barrel, whereas West Texas Intermediate (WTI) was valued at around $72.46. In the precious metals market, gold prices surged to an all-time high due to increased demand for safe-haven assets amidst concerns over U.S. tariffs.

Additionally, market participants were focused on an important inflation report for insights into the Federal Reserve’s future policy direction, with gold trading at approximately $2,796.15 per ounce.

Analysts at AIICO Capital Limited expect continued volatility as investors anticipate a meeting by the Organisation of the Petroleum Exporting Countries and its allies, including Russia, collectively known as OPEC+, scheduled for February 3. #Naira Extends Rally as IOCs, FPIs, CBN Boost FX Liquidity BEDC Builds New 33kv Feeder Line to Improve Power Supply in Edo