Yields Maintain Uptrend as Investors Sustain Sell-off in T-Bills

Yields on gilt edge instruments maintain uptrend in the fixed income market on Monday, following an uptick recorded in average Treasury bill on Friday.

Greenwich Merchant Bank Limited in a note stated that investors sustained sell-off in the T-bills market with yields notching higher by 3 basis points.

Mirroring Friday’s session, the market narrowed focus on the 14-Oct-21 instrument (+6bps) although profit-taking was less intense than was previously seen.

Later this week, ₦50.9 billion worth of bills will be maturing and the CBN is expected to roll over all the bills, says analyst at Greenwich Merchant Bank.

It was however observed that following the bi-weekly FX auction on Friday, the system liquidity tanked 67.6% to open at ₦224.6 billion.

Notwithstanding, funding rates softened to 1.4% for the Over Night rate and 1.7% for Open Buy Back from 3.6% and 4.3%.

In the open market operations (OMO) market, the mood was bearish amid pockets of selloffs across the tickers.

After trade, the average yield rose 8bps to 0.3% mostly influenced by activities along the mid to end of the curve.

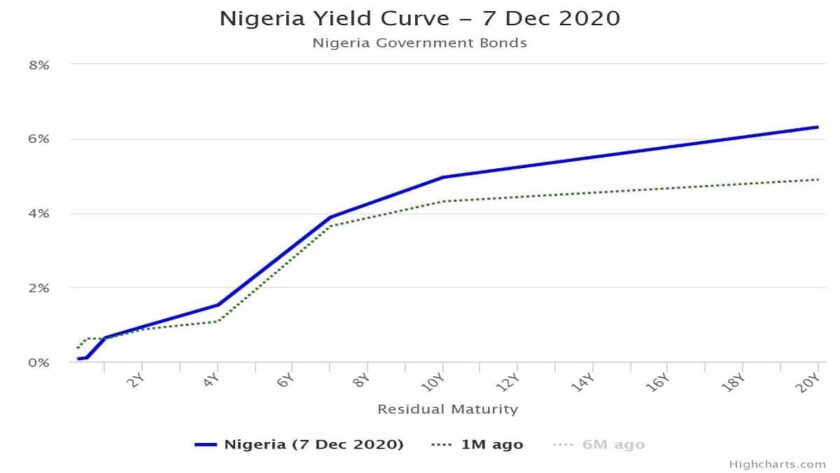

Analysts said the Bond market yields edged up as investors booked gains to start the week bearish.

As a result, the yield curve expanded by 7bps to average 4.2%.

Read Also: Analysts expect yields on Treasury-Bills to moderate in November

In focus, Greenwich hinted that the mid (+12bps) and short (+8bps) segments drove the market amid noticeable apathy towards the long end of the curve.

However, market data showed that the 23-FEB-2028 (+62bps) and 27-JAN-2022 (+53bps) instruments saw the biggest yield increase.

Farther on, the Naira reversed gains in the Parallel FX market and traded at ₦482.00 to a dollar from ₦472.00, depreciating ₦10.00 per dollar, after easing off its year-high last week.

Meanwhile, at Investors and Exporters Window, the local currency held steady at ₦395.00/USD.