Yield on Treasury Bills Stands Down as Bond Rally ahead of DMO Auction

Upturning six trading session bearish trend, bond market rally ahead of Debt Management Office (DMO) auction on Wednesday as average yields on Treasury Bills remained flat.

In the money market, funding pressures eased slightly as financial system liquidity opened significantly higher at N668.3 billion from N382.7 billion on Monday.

The robust liquidity was partly supported by open market operations (OMO) repayment estimated at N283.2 billion.

As a result, the Open Buy Back (OBB) and Overnight (OVN) rates eased by 5bps and 14bps to 0.63% and 0.94% respectively.

“We expect funding pressures to remain benign, at least until Friday when liquidity will be squeezed by the settlement of the monthly bond auction holding tomorrow”, Chapel Hill Denham hinted in a note.

Similarly, Greenwich Merchant Bank also expects system liquidity to weigh on stop rates at the auction.

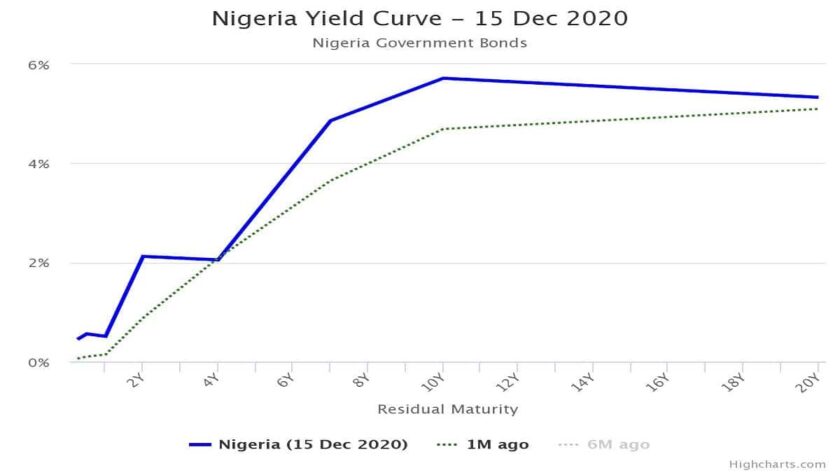

However, amidst inflation rate increased, yields traded range bound ahead of the Debt Management Office (DMO) monthly bond auction holding tomorrow.

Notably, short term rates closed flat, as the NTB and OMO benchmark curves were unchanged at an average of 0.53% and 0.41% respectively.

Elsewhere, in the bond segment, analysts at Chapel Hill Denham said they saw more volatility, albeit with a slight bullish bias.

Yields compressed marginally by an average of 1bp across the benchmark curve, mostly due to interest in the short (-5bps to 2.43%) and long (-2bps to 6.91%) end of the curve.

Earlier today, the National Bureau of Statistics (NBS) published the Consumer Price Index (CPI) report for November 2020.

The report showed pressures on consumer prices remained unrelenting, as headline inflation rate rose the fastest in four years, surging by 65bps to a 34-month high of 14.89% year on year in November.

The higher inflation print was wholly driven by higher food prices, while core inflation surprised positively.

Analysts at Chapel Hill Denham said they are tracking December inflation print at 15.00%, and do not expect the headline index to buck the currency inflationary trend until Q2-2021.

As scheduled, a bond auction is expected to be conducted by the DMO on Wednesday.

The total amount on offer is N60 billion, divided equally across the MAR2035 and JUL2045 instruments, respectively.

The previous auction closed at 5.00% and 5.785% respectively.

Investors will be paying close attention to the outcome of the auction, to gauge the direction of yields in the near term, analysts said.

In the currency market, the exchange rates were unchanged at N379.00, N380.69, and N394.00 at the official, SMIS windows, and the I&E Window, respectively.

Similarly, the Naira closed flat at the parallel market at N475.00 as external reserves plunged 1.6% month to date to US$34.85 billion.

Read Also: Yields Rise as CBN Issue ₦4trn worth of Special Bills

But, analysts are projecting that this is likely to increase in coming days, following the approval by the World Bank, of the US$1.5 billion loan to sub-national entities.

Yield on Treasury Bills Stands Down as Bond Rally ahead of DMO Auction