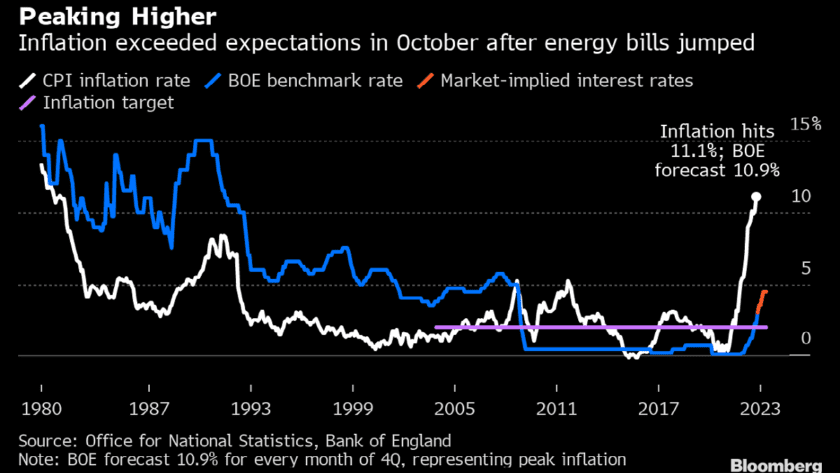

UK Inflation Hits 41-Year High at 11.1%

UK inflation hits a 41-year high last month as higher energy prices led to the consumer price index (CPI) data exceeding expectations, as well as the Bank of England (BoE) forecast for its peak.

At 11.1%, the data implies a considerable squeeze on real incomes, with the pace far exceeding wages, which were confirmed to have risen 6% in the three months to September, yesterday -5.7% excluding bonuses.

The only upside is that this is expected to be as high as it gets, according to analyst notes. Of course, just as important is how quickly it’s going to fall and the latest surprise to the upside isn’t going to fill people with optimism.

But with the cost-of-living crisis tipping the economy into recession, rising interest rates and the government about to enact a severe fiscal tightening, it’s hard to imagine high inflation being sustainable.

“With that in mind, I expect Bank of England Governor Andrew Bailey and his colleagues to continue to push back against the prospect of rates rising much further, as they did after the last meeting when highlighted the trajectory for growth and inflation under market-based expectations for interest rates”, said. Craig Erlam, Senior Market Analyst at OANDA.

Today’s surprise will be another blow for the central bank but I doubt it drastically changes its outlook.

Meanwhile, oil prices are softer on Wednesday after a brief bout of volatility late Tuesday following reports of missile strikes in Poland. That unsurprisingly jolted financial markets, sending oil prices higher initially, but that quickly settled and crude prices are now back where they were before.

It goes without saying that any significant escalation in the war in Ukraine will likely add a substantial risk premium to oil prices, with Russia being a major producer and exporter, as well as one of the leaders in the OPEC+ alliance. READ: Bank of England Books Biggest Rate Hike in 27 Years

A strike on a NATO member is an extreme example of that and could send oil markets into a frenzy. Thankfully, worst fears haven’t been realised but investigations are still taking place which will keep oil traders on edge. # UK Inflation Hits 41-Year High at 11.1%