Sub-Saharan African Markets Susceptible to EU Growth Shock

As recession tantrum among developed markets is getting louder, countries in the Sub-Saharan African (SSA) markets have been pointed to be on the receiving ends of now more probable economic downturn in the European Union (EU) economic bloc.

The United Nations (UN) Development Programme applies the classification of the Sub-Saharan African market to 46 of Africa’s 54 countries, excluding Djibouti, Somalia, and Sudan.

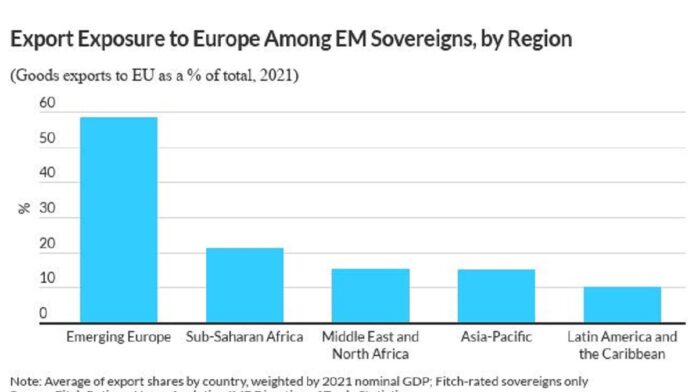

Data from Fitch shows that emerging market exports to the European Union stood at about 20% on average in 2021, ahead of the Middle East and North Africa, Asia-Pacific and Latin America and the Caribbean.

Apart from a decline in the European Union bloc, there is a possibility that the United States economy will slip into a trough as gross domestic product growth slowdown while inflation pressures bite.

A recession in Europe, which is becoming more likely, would increase external strains and growth challenges for some vulnerable non-European sovereigns, including several in North Africa and South Asia that have high export exposure to the EU, says Fitch Ratings.

The global ratings forecast the Eurozone economy to expand by 2.6% in 2022 and 2.1% in 2023, but it has now been noted that the recent sharp drop in gas export volume from Russia to Europe has raised the likelihood of gas rationing.

According to the firm, this makes a technical recession in the Eurozone an increasing possibility. Stretched further, it said emerging markets in central and Eastern Europe would be affected by the gas rationing itself. Moreover, these markets have strong trade links to developed economies in Western Europe that are also exposed to gas-supply disruption.

“Outside Europe, EMs in sub-Saharan Africa have the greatest export exposure to the EU, while those in Latin America and the Caribbean have the lowest”. READ: FX Rationing to Persist on Low Inflows, Rising Outflows –NOVA

It said there are also pockets of vulnerability in certain narrower geographic regions; for instance, the proportion of goods exports to the EU is particularly high in North Africa, at 61% in Morocco, 67% in Tunisia and 31% in Egypt.

Exports to the EU are also substantial for a number of south Asian markets, including Bangladesh, at 38%, Pakistan, 26% and Sri Lanka, 24%, according to Fitch Ratings.

Any shock to external demand in Sri Lanka is likely to exacerbate the pressure stemming from its already acute shortage of foreign exchange and the supply-chain disruption confronting exporters, it added.

A recession in the EU is also likely to cause a drop-off in outbound European tourism. This could hold back tourism recoveries after the Covid-19 pandemic in markets that have traditionally seen a large share of European arrivals.

A sudden stop of Russian gas supplies to Europe could push up global gas prices, benefiting gas exporters, such as Qatar, though most of Qatar’s gas exports are through long-term contracts. However, the global rating said the credit effects on EM exporters and importers of other fossil fuels are less clear.

“Weaker demand in Europe could dampen global oil prices, particularly in the context of our baseline forecast for the US economy to slow”. However, it noted that some gas consumers may switch to other fuel sources, partially offsetting this effect.

In the longer term, efforts to reduce reliance on Russian fuel supplies could accelerate decarbonisation in Europe, putting added downward pressure on fossil fuel prices.

The likelihood of gas rationing in Europe has increased significantly following the recent disruption of Russian natural gas supplies through the Nord Stream 1 pipeline. A technical recession in the eurozone is now an increasing possibility, Fitch Ratings says.

The recent drop in Russian gas flows to Europe has renewed concerns that Russia is prepared to use gas exports as a political tool, with Germany recently activating phase two of its national gas emergency plan.

Continued disruption of gas imports through the Nord Stream 1 pipeline, unless offset with higher flows via other pipelines, would hinder the continent’s ability to meet gas needs during the peak winter heating season, despite efforts to build reserves and reduce reliance on Russian gas.

This means gas rationing to industrial users is now an increasingly likely scenario, which we estimate could cut eurozone gross domestic product (GDP) growth by between 1pp and 2pp in 2023, according to a report.

Rationing would dent output for industries utilising gas as a key input, with a knock-on impact on firms throughout the supply chain. Russian imports have accounted for around 30% of eurozone and 60% of German gas consumption in recent years.

Fitch recently analysed the potential impact of gas rationing through supply-chain linkages using an input-output framework. This showed a 2% and 4% shock to the eurozone and German economies, respectively, in the event of a complete and sudden loss of Russian gas supplies.

This represents an upper bound on the impact through supply chains since it assumes no replacement of Russian gas with other energy sources. #Sub-Saharan African Markets Susceptible to EU Growth Shock