Stock Market Return Dips as Investors Lose N164bn

The equities segment of the Nigerian Exchange (NGX) shrinks by about N164 billion due to selloffs in large and mid-capitalised listed companies’ stock traded in the local bourse.

MarketForces Africa reported that the just concluded experience a bear riot as traders cut back portfolio holdings as the third quarter earnings season momentum begins to slow down.

According to data from the Nigerian bourse, key performance indicators have plunged amidst low investing sentiment on companies’ shares. Last week, the domestic bourse All-Share Index lower by 0.7% to close at 43,968.75 points.

Year-to-date return moderated to 2.9% from 3.6% while market capitalisation shed ₦163.6 billion to close at ₦23.9 trillion on Friday.

NGX recorded that the level of trading activities in the week varied as the total traded volume dipped by 21.9% to 1.10 billion units. Meanwhile, the total weekly traded value inched northward by 7.30% to N11.71 billion and then the total deals traded for the week took a free fall by 17.07% to 15,697 deals from 18,928 deals in the previous week

ACCESSCORP with 218.6 million units was the most traded stock followed by 179.1 million shares of STERLNBANK that were transacted and 67.8 million of TRANSCORP exchange hands.

Again, ACCESSCORP led by share value transacted which printed at ₦1.7 billion while investors traded ₦1.2 billion of GEREGU, and ₦1.1 billion worth of Zenith Bank shares. In a market report, Afrinvest said the performance was bearish across sectors within its coverage as only 1 of 6 indices gained.

The Insurance and Consumer Goods indices led laggards, down 2.2% and 1.9% week on week respectively on the back of losses in PRESTIGE, NEM, GUINNESS, and FLOURMILL.

Trading data shows that PRESTIGE lost 15.2% of its market valuation, while NEM declined by 7.5% and GUINNESS dipped by 10% and FLOURMILL 9.9%

The AFR-ICT and Oil & Gas indices dipped 1.1% and 0.7% week on week respectively following price decline in MTNN, AIRTELAF, and OANDO. MTNN share price dropped by 2% while AIRTELAF weakened by 0.4% and OANDO lost 5.6%

Similarly, price depreciation in DANGCEM (-0.8%) dragged the Industrial Goods index lower by 0.3% week on week, according to Afrinvest stock market report. READ: NASD Shrinks N20bn as Market Priced Down Shares

On the flip side, stockbrokers noted there was buying interest in UNITYBNK with 35.7% share appreciation and UBA popped higher by 2.9% – thus pushing the Banking index up 0.1% week on week.

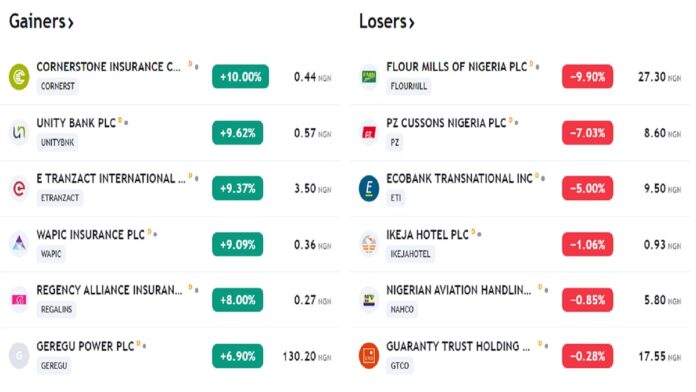

Stockbrokers said Investor sentiment, as measured by market breadth, strengthened to -0.11x versus -0.24x recorded in the previous week as 25 stocks gained, 35 lost while 92 were unchanged.

The top outperforming stocks for the week were UNITYBNK (+35.7%), ROYALEX (+22.2%), and ETRANZACT (+9.4%) while PRESTIGE (-15.2%), LEARNAFR (-10.7%), and GUINNESS (-10.0%) were the top underperforming stocks. #Stock Market Return Dips as Investors Lose N164bn