NSE Records ₦325.3 billion Gain on Sustained Buying Interest

The Nigerian Stock Exchange, NSE, records ₦325.3 billion gain on sustained buying interest in some blue chip stocks on Thursday.

Marking fourth bullish trading session in the week, investors wealth has continue to expand as yields in the fixed income market remain unimpressive.

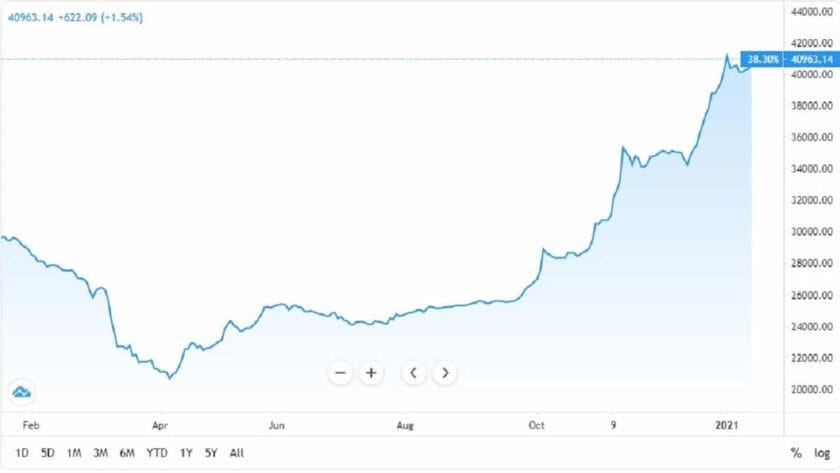

As a result of strong buying interest in DANGCEM (+3.0%), MTNN (+1.8%) and SEPLAT (+8.8%), the All-Share index appreciated 154bps to 40,963.14points.

Consequently, year-to-date return improved to 1.7% while market capitalisation advanced by settle at ₦21.4 trillion.

Activity level rebounded as volume and value traded rose 72.9% and 27.9% respectively to 809.4 million units and ₦8.9 billion.

The most traded stocks by volume were TRANSCORP (136.6m units), MBENEFIT (70.6m units) and GUARANTY (69.0m units).

GUARANTY (₦2.3bn), WAPCO (₦1.4bn) and ZENITH (₦1.1bn) topped by transaction by value.

According to Afrinvest, performance across sectors was positive as all indices under its analysts coverage gained.

The Insurance index maintained dominance, advancing 5.3% due to price uptick in MANSARD (+9.4%), WAPIC (+8.7%) and AIICO (+1.7%).

Similarly, the Oil & Gas and Banking indices appreciated 5.2% and 2.4% respectively due to buying interest in SEPLAT (+8.8%), ARDOVA (+9.3%), GUARANTY (+1.9%), and ZENITH (+1.9%).

The Industrial and Consumer Goods indices also gained 1.7% and 0.7% respectively as DANGCEM (+3.0%), WAPCO (+4.0%), DANGSUGAR (+3.6%), and NASCON (+9.7%) ticked higher.

Afrinvest hinted that the AFR-ICT index increased 72bps on the back of price appreciation in MTNN (+1.8%).

Investor sentiment as measured by market breadth surged to 6.9x from the 1.9x recorded previously as 48 stocks advanced against 7 decliners.

CHAMPION (+9.8%), NASCON (+9.7%) and MANSARD (+9.4%) were the best-performing tickers.

Meanwhile COURTVILLE (-8.3%), NEIMETH (-6.4%) and UNIONDAC (-3.1%) were the losers.

“We are optimistic that the market will close on a positive note this week”, Afrinvest stated.

Read Also: Gilt-edged Securities Investors Double Down on FGN Bond

NSE Records ₦325.3 billion Gain on Sustained Buying Interest