NSE Records ₦166.5Bn Gain on Improve Buying Interest

The equities segment of the Nigerian Stock Exchange, NSE, records ₦166.5billion gain on Thursday on improved buying interests.

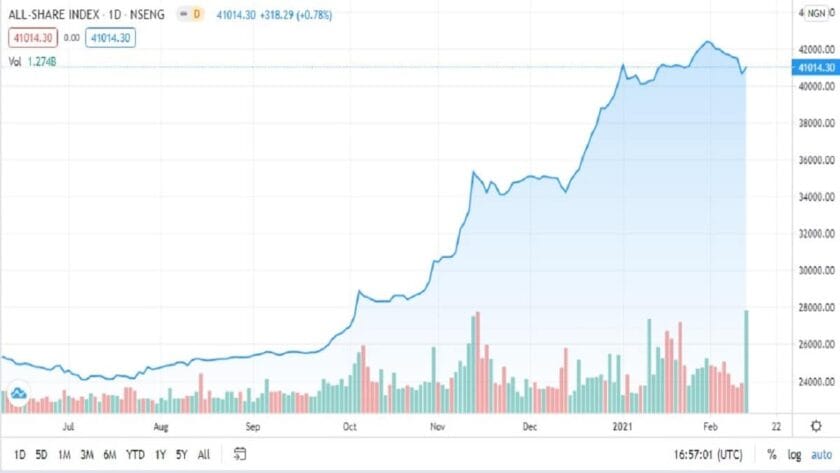

Today, the local bourse posted a bullish performance as the benchmark index rose 78 basis points (bps) to 41,014.30 points.

Market positive performance came on account of buying interest in DANGCEM (+7.0%), MTNN (+1.6%), and UNILEVER (+2.6%).

Consequently, year to date (YTD) return increased to 1.8% while market capitalisation inched higher to settle at ₦21.5 trillion.

Market records shows that activity level improved as volume and value traded rose 247.4% and 16.7% respectively to 1.3 billion units and ₦6.4 billion.

The most traded stocks by volume were TRANSCORP (55.7 million units), FBNH (51.9 million units) and UBA (48.8 million units).

Meanwhile MTNN (₦1.6 billion), ZENITH (₦885.3 million) and GUARANTY (₦579.7 million) led by value.

Afrinvest said in a note that performance across sectors was bearish as 4 of 6 indices under its coverage declined.

The Banking and Insurance indices lost 3.0% and 2.9% respectively due to sell-offs in GUARANTY (-5.1%), UBN (-8.9%), AIICO (-9.0%) and MANSARD (-3.1%).

Similarly, the Oil & Gas and Consumer Goods indices fell 0.9% and 0.3% respectively following sell pressures in OANDO (-6.7%), ARDOVA (-7.5%), INTBREW (-2.3%) and CHAMPION (-8.9%).

Conversely, the Industrial Goods and AFR-ICT indices rose 2.6% and 0.8% respectively on account of buying interest in DANGCEM (+7.0%) and MTNN (+1.6%) stocks.

Then, investor sentiment as measured by market breadth weakened to 0.2x from the 0.4x recorded previously as 7 stocks gained against 45 losers.

DANGCEM (+7.0%), MBENEFIT (+5.4%) and SOVRENINS (+3.7%) were the top gainers.

Just as LINKASSURE (-10.0%), LIVESTOCK (-10.0%) and NAHCO (-10.0%) were the top losers.

“For the week, we expect the equities market to close in the red”, Afrinvest stated.

NSE Records ₦166.5Bn Gain on Improve Buying Interest