NSE Rebounds with ₦50.3bn Gain after 2-Day Cold Streaks

The Nigerian Stock Exchange, NSE, rebounds Wednesday with ₦50.3 billion after two trading session cold streak in the week.

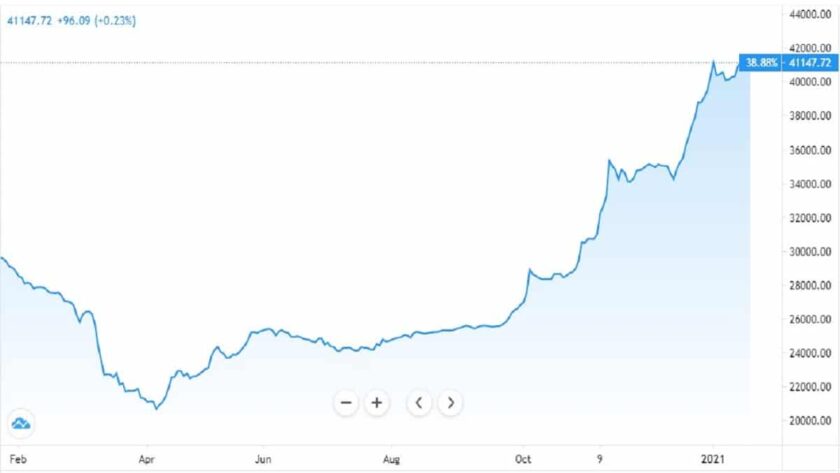

Following two consecutive losses, the local bourse rallied as the NSE All-Share Index rose 23 basis points (bps) to close at 41,147.72 points.

The uptrend was due to buying interest in WAPCO (+8.2%), UBA (+2.3%), and TRANSCORP (+9.4%).

As a result, year to date return rose to 2.2% while market capitalisation increased to ₦21.5 trillion.

Activity level was mixed as volume traded rose 23.7% to 649.6 million units while value traded fell 13.6% to ₦4.6 billion.

The most traded stocks by volume were MBENEFIT (52.1 million units), TRANSCORP (51.7 million units), and STERLING (48.1 million units).

WAPCO (₦900.1 million), GUARANTY (₦803.6 million), and DANGCEM (₦410.6 million) topped by value.

Afrinvest said performance across sectors was largely bullish as 5 of 6 indices under its coverage closed in the green save the Banking index which lost 0.2%.

Decline in banking index was attributed to sell-offs in GUARANTY (-2.1%).

Conversely, the Insurance and Industrial Goods indices rose 2.5% and 0.5% respectively on the back of gains in AIICO (+9.7%), NEM (+6.3%) and WAPCO (+8.2%).

Similarly, the Oil & Gas and Consumer Goods indices gained 0.4% and 0.2% respectively due to buying interest in ARDOVA (+9.7%), FLOURMILL (+1.6%) and PZ (+5.6%).

Meanwhile, Afrinvest hinted that price appreciation in MTNN (+0.1%) drove the AFR-ICT index 0.1% higher.

Investor sentiment as measured by market breadth strengthened to 3.7x from the 2.0x recorded previously as 55 stocks advanced against 15 decliners.

MBENEFIT (+10.0%), ROYALEX (+10.0%) and DEAPCAP (+10.0%) were the best-performing tickers.

SUNASSUR (-10.0%), MANSARD (-10.0%) and AFROMEDIA (-9.1%) were the losers.

“We expect the equities market to sustain this bullish performance given the positive investor sentiment”, Afrinvest said.

Read Also: FX liquidity Could Trigger Foreign Investors Exits

NSE Rebounds with ₦50.3bn Gain after 2-Day Cold Streak