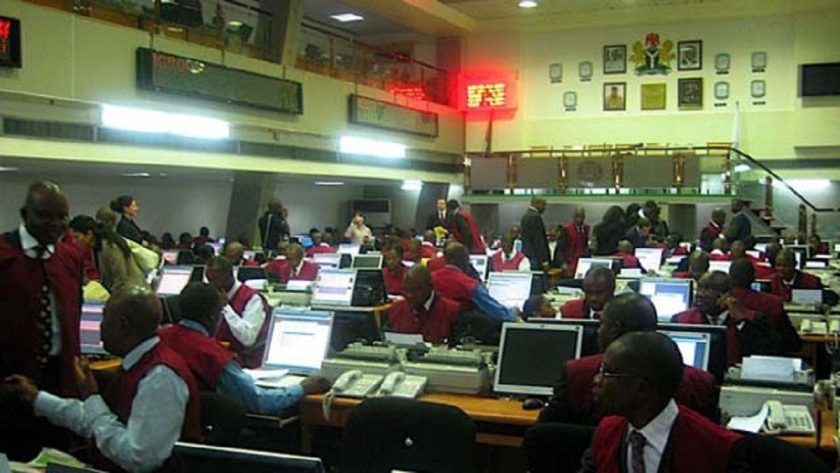

Nigerian Exchange Jumps by N428bn as Financial Stocks Rally

The Nigerian Exchange, NGX, rose by N428 billion following buying interest in large, mid, and small caps companies’ stock; a healthy rebound from last week’s rout.

The market witnessed strong bargain-hunting activities across tickers with attractive entry points, according to stockbrokers, pushing NGX indicators upward.

The Nigerian Exchange All-Share Index inched higher by 1.5% week on week to 52,973.88 points, and year-to-date return hit 3.4%, recovering from selling rallies.

Precisely, investors’ interests in NESTLE (+10.0%) and MTNN (+1.5%) spurred the weekly gain. Activity level was mixed as average volume fell 30.0% to 329.1 million units while average traded value improved 5.7% to ₦6.8 billion, according to market data.

The most traded stocks by volume were UBA (244.6m units), ACCESSCORP (204.1m units), and ZENITH (189.4 million units), while ZENITH (₦5.0 billion), GEREGU (₦4.0 billion), and GTCO (₦3.1 billion) led by value.

In its market report, Afrinvest Limited said the bulls dominated proceedings across sectors under its analysts’ coverage, save for the Industrial Goods index which faltered 0.7% following the 2.2% w/w decline in the share price of BUACEMENT.

For the gainers, the Banking and Insurance indices led the park, up 5.6% and 3.6% respectively, due to price appreciation in UBA, Zenith, LASACO, and AIICO among others.

Data from the exchange showed that UBA gained 11.4%, ZENITH rose by 3.8%, LASACO jumped by 14.5% and AIICO popped up +6.9%.

Trailing, the Oil & Gas, Consumer Goods, and AFR-ICT indices advanced 3.2%, 3.1%, and 0.8% week on week respectively. The growth was spurred by share appreciation in Total, Nestle Nigeria, and MTN Nigeria.

TOTAL inched higher by 14.5%, NESTLE rose by 10.0%, and MTNN jumped higher by 1.5% in the last five trading sessions in the local bourse.

With the positive price movement, investor sentiment, measured by market breadth, strengthened to 0.6x from 0.2x the prior week, as 60 stocks gained, 20 lost while 71 closed flat.

FTNCOCOA (+54.5%), RTBRISCO (+40.7%), and CHAMS (+36.7%) led the top gainers while SOVERENIN (-20.0%), CHELLARAM (-18.8%), and ARDOVA (-13.9%) led the decliners.

The performances across sectors were broadly positive AS the Banking (+5.6%), Insurance (+3.6%), Oil and Gas (+3.2%), and Consumer Goods (+3.1%) – save for the Industrial Goods (-0.9%) index, posted gains.

Stock market analysts said they anticipate a bearish tilt in the aggregate market performance due to the shortage of sustainable positive catalysts.

Overall, the equities market capitalisation nudged higher by ₦428.0 billion to ₦28.8 trillion while the year-to-date return recovered to 3.4% from a low of 1.8% in the previous week. #Nigerian Exchange Jumps by N428bn as Financial Stocks Rally

Naira Steadies as Banks Issue Update on FX Purchase