Nigerian Exchange Gets Approval for 7 Derivatives Contracts from SEC

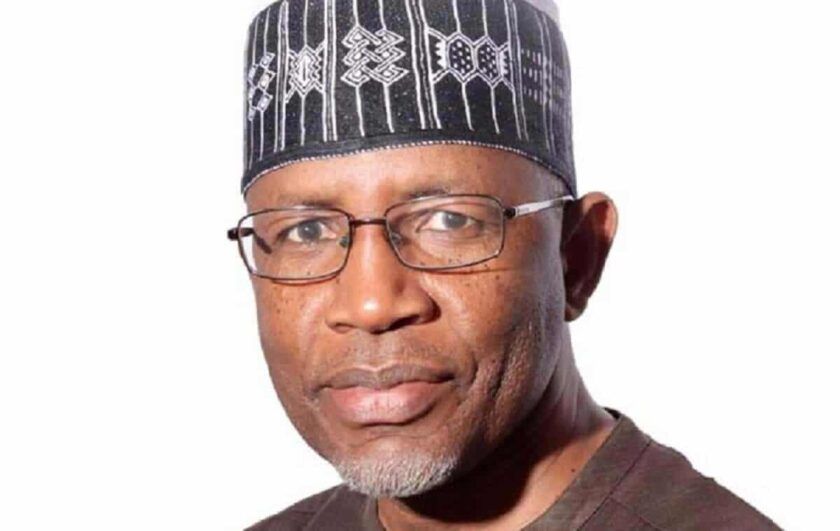

The Nigerian Exchange (NGX) Limited has announced that it has received approval for seven derivatives contracts from the Securities and Exchange Commission (SEC) on June 28. The NGX Chief Executive Officer, Mr Temi Popoola, disclosed this in a statement made available on Friday in Lagos.

Popoola said the approved contracts were; Access Bank Plc Stock Futures, Dangote Cement Plc Stock Futures, Guaranty Trust Bank Plc Stock Futures, MTN Nigeria Communications Plc Stock Futures, Zenith Bank Plc Stock Futures, NGX 30 Index Futures, and NGX Pension Index Futures.

He noted that the announcement followed the successful registration of NG Clearing by SEC, as a premier Central Counterparty, effective June 7.

According to him, with these approvals, NGX is inching closer to launch West-Africa’s first Exchange Traded Derivatives (ETDs) supported by NG Clearing in the risk management process.

“The launch of the derivatives market aligns with our commitment to build a market that thrives on innovation and responds to the needs of stakeholders in accessing and using capital.

“We are, therefore, excited about the prospects of deepening Africa’s position in the global financial markets through ETDs.

“As well as enhancing liquidity and mitigating against price, duration and other financial risks that may arise from sophisticated financial transactional activities,” he said.

He said the NGX had continued to ensure widespread understanding of derivatives, its applicability and how investors can reap maximum value from the asset class ahead of thr launch of the ETDs.

“NGX has collaborated with both local and international organisations such as SEC, JPMorgan Chase, CBOE Options Institute, and NG Clearing to facilitate in-depth capacity building programme on the derivatives market.

“In addition, through its learning and development arm, X-Academy, NGX has hosted trainings to prepare capital market players who wish to undertake the Chartered Institute for Securities & Investment UK Global Derivatives qualification exam, and is on track to host further trainings for other stakeholders in the near term.

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset or group of assets.

The common underlying instruments include bonds, commodities, currencies, interest rates, market indices and stocks: the basic principle behind a derivative contract is to earn profits by speculating on the value of the underlying asset at a future date.

Derivatives are used as a risk management instrument, and are suited to both professional and private investors.

Nigerian Exchange Gets Approval for 7 Derivatives Contracts from SEC