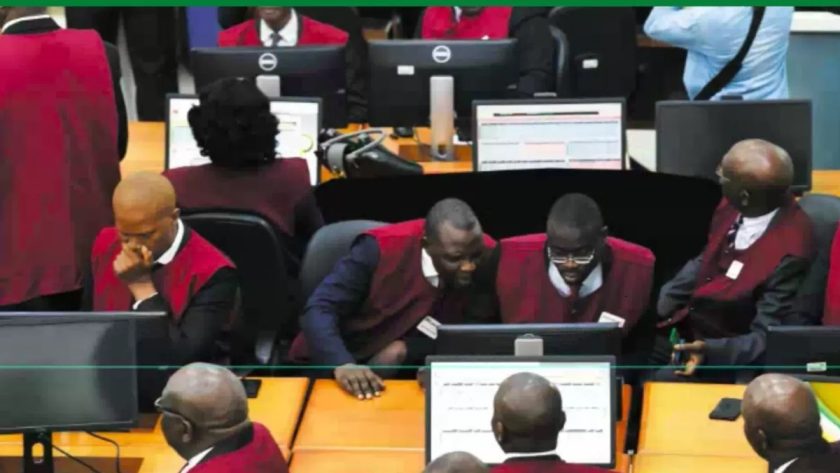

NGX Rises by N440bn as Banking Stocks Rally

The equities segment of the Nigerian Exchange (NGX) recovered midweek from a selling rally with increasing positioning on financial service stocks. Investors’ wealth spiked by more than N440 billion, and year-to-date return accelerated above 20% versus annual inflation of 22.41%.

Consequent to bargaining hunting that dominated today’s trading activities on the floor of the exchange, the market index or All-Share Index advanced by 133 basis points to close at 61,523.57 points from 60,715.04 points record on Tuesday.

Ticker: BUACEMENT, PRESCO, CONOIL, ACCESSCORP, FBNH, UBA, WAPCO, GTCO, and ZENITH BANK were the toast of investors’ midweek, data from the local bourse indicated.

These individual price appreciation in BUACEMENT (+9.44%), PRESCO (+7.73%), CONOIL (+5.68%), FBNH (+3.35%), GTCO (+2.56%), ACCESSCORP (+4.37%), and DANGSUGAR (+1.20%) drove the day’s uptrend.

Trading records showed that the total volume traded declined by 23.6% to 846.32 million units, valued at N10.31 billion, and exchanged in 9,815 deals. By record, FBNH was the most traded stock by volume and value at 89.24 million units and NGN1.65 billion, respectively.

In their separate daily update, stockbrokers said the improved market temperature pushed the Year to Date return to 20.04%. As measured by market breadth, market sentiment was positive (1.4x), as 43 tickers gained relative to 30 losers.

LEARNAFRCA gained 10.0% and GOLDBREW popped up 10.0% to top the gainers’ list, while NEM lost 10.0% just like LASACO (-10.0%) to record the highest losses for the day.

Breakdown across sub-sector gauges indicated that four out of the five indices closed in positive. The Banking index popped up 6.2%, Industrial Goods rose 3.9%, and Oil & Gas index added 0.2%. Also, the Consumer Goods index increased by 0.1% while the Insurance declined by 4.7%.

Overall, equities market capitalisation surged by N440.38 billion, representing a rise of +1.33%, to close at ₦33,500.19 trillion from ₦33,059.81 trillion. #NGX Rises by N440bn as Banking Stocks Rally Nigerian Treasury Bills Yield Rises to 7%