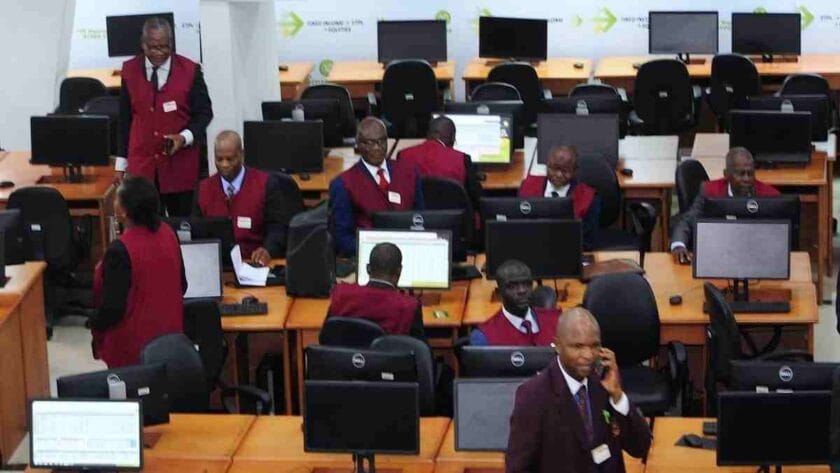

NGX Gains N20.9 Billion on Improved Investors Sentiment

Some listed stocks on Nigerian Exchange (NGX) appreciate by N20 billion first trading day in the week as equities investors sentiment improve amidst yield repricing in the fixed income market.

After closing the last week on negative note, Nigeria’s equity sentiment got off to a positive start, following investors’ interest across major counters, especially among tier 1 banking stocks and MTNN.

Precisely, the benchmark index rose by 12 basis points (bps) to 38,854.73 points. Thus, year to date loss moderated to 3.52%, while the Market Capitalisation dipped to N20.2 trillion.

Analysts at Chapel Hill Denham said they view the blend of elevated inflationary pressure and the still present FX pressures, as the major threat to any possible dovish move by the CBN.

“For us, we believe the hunt for loftier premium in the fixed income market, to at least, make up for the bourgeoning inflation will continue to drive fixed income yield uptick, a development that will, in turn, spook equity investors”.

On today’s price list, FCMB (+9.77% to N2.92), NNFM (+9.35% to N5.85%), and UPL (+9.35% to N1.17) were today’s top gaining stocks. On the flip side, FTNCOCOA (-10.00% to N0.45), UNITYBNK (-7.81% to N0.59), and UAC-PROP (-5.06% to N0.75) were today’s top losers.

Performance across Chapel Hill Denham’s coverage universe was largely bullish. Notably, the firm said only 1 of 5 under its coverage indices closed in the red terrain.

The NSE oil & gas index closed negative, declining by 22bps. This was offset by the gains recorded across the NSE insurance, NSE banking, and NSE consumer goods indices, all of which rose by 41bp, 28bps, and 8bps, respectively.

The NSE industrial goods index closed flat.

The market’s activity was broadly bullish, with the total volume rising by 93.76% to 509 million, valued at N32.101 billion. Today’s most traded stocks by volume were MTNN (181.73 million units), FIDELITYBK (106.88mn units), and FBNH (35.02mn units).

On the other hand, the top traded stocks by value were MTNN (N29.677 billion), ZENITHBANK (0.393 billion), and GUARANTY (0.376 billion).

Elsewhere, the Chapel Hill Denham’s Paramount Equity Fund (PEF) closed flat, while the Women Investment Fund (WIF) rose by 15bps.

Read Also: Onyema Completes Tenure as Nigerian Stock Exchange Chief Executive

NGX Gains N20.9 Billion on Improved Investors Sentiment