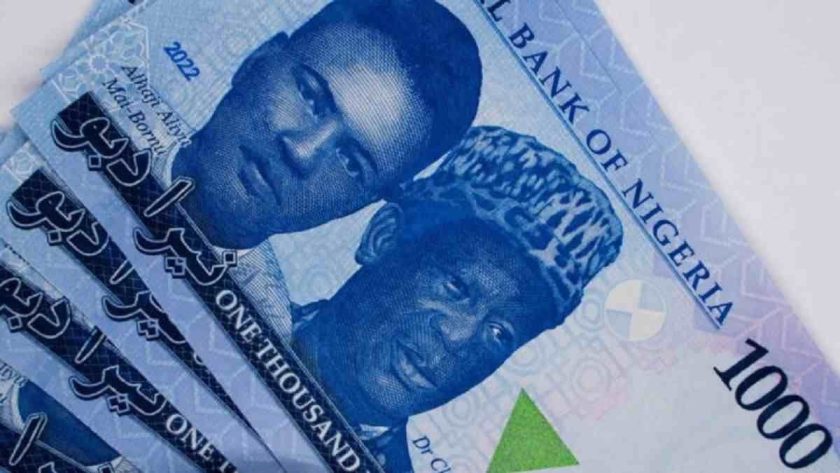

Naira Gains N9 as Fresh Inflows Boost Foreign Reserves

The naira gained further in the currency market to close at N1,520.00 per dollar, supported by increased U.S dollar liquidity, with trades ranging between N1,520 and N1,530 per greenback

Market confidence reflated this week as data showed Nigeria’s external reserves reversed its persistent downtrend. The gross external reserves increased to $37.282 billion on Tuesday following two successive inflows from an unidentified source.

Based on the latest spot FX data update from the Central Bank of Nigeria (CBN), the official exchange rate for the day settled at N1520.7490 per dollar, from N1529.22 the previous day.

The exchange rate has maintained an uptrend against the greenback despite near-zero FX intervention in July. Dangote refinery has reduced FX pressure from refined product demand. Forex market sentiment has improved with rates closer to fair value. Offshore participation in the CBN open market operations continues to boost FX inflows.

The majority of investment bankers in Nigeria have turned to naira bulls, with year-end projections ranging between N1560 and N1700 per dollar in the absence of significant demand shock.

Oil prices climbed on Wednesday, supported by strong U.S. gasoline demand, renewed Red Sea shipping attacks, and a forecast for reduced U.S. oil output. Brent crude rose 38 cents, or 0.54%, to $70.53 per barrel, while U.S. West Texas Intermediate (WTI) crude gained 43 cents, or 0.63%, to $68.76.

Meanwhile, gold prices edged higher as investors monitored ongoing trade negotiations involving the U.S., although gains were capped by a firmer U.S. dollar. Spot gold was up 0.3% at $3,309.24 per ounce after touching its lowest level since June 30 earlier in the session.

Analysts said oil prices should hold steady in the global commodity market as US stockpiles increased strongly. Despite months of supply increases, inventory levels remain tight, indicating strong demand is absorbing the extra supply #Naira Gains N9 as Fresh Inflows Boost Foreign Reserves DMO Raises N799bn from Bonds, Rejects 49% of Total Bids in Q2