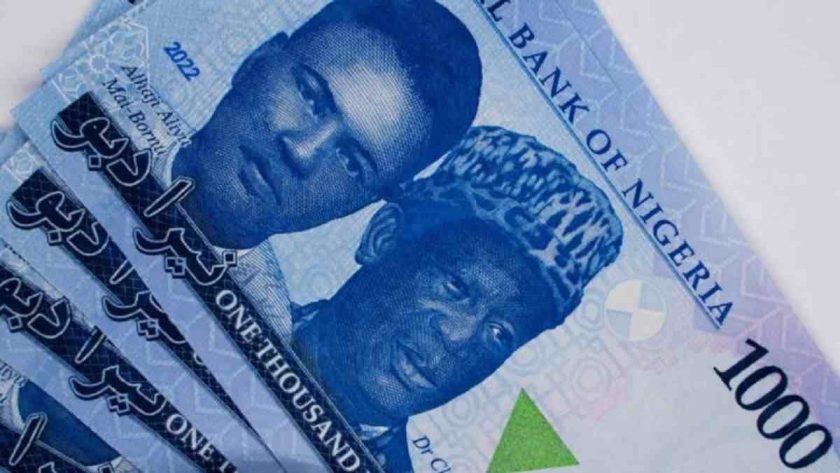

Naira Forward FX Rates Gain Across Contracts on Renew Confidence

The naira appreciated across contracts in the forward FX market as sustained increase in external reserves gross balance boosted corporate FX users’ confidence. A growing number of FX users with foreign currencies liability that took an offsetting positions at forward market saw the naira appreciated across contract last week.

The naira rates appreciated across the 1-month, 3-month, 6-month and 1-year contracts, according to Cordros Capital Limited. Forward FX contract for one month appreciated by 0.3% to N1,572.95 per dollar, analysts at Cordros Capital Limited said in a note.

The investment firm also noted that three months forward fx contract gained 0.6% to close at N1,644.11 per greenback, reflecting positive expectation on the local currency strength in the short term. Details release also revealed that six month FX forward contract rate gained 1% to settle at N1,745.85 while one year contract strengthened by 1.4% to N1,948.07.

“FX market participants and some contract holders take an offsetting position in a currency pair to protect against potential losses from adverse movements in exchange rates”, experts told MarketForces Africa.

The naira is expected to remain stable, underpinned by robust US dollar liquidity at the official window and an efficient FX market, separate analysts said. “We expect sustained inflows from foreign portfolio investors (FPIs) due to existing carry trade opportunities and stronger market confidence.

“Additionally, improving non-oil exports, as well as limited incentives for naira speculation, are expected to reinforce steady inflows from domestic sources”, Cordros Capital Limited. The naira appreciated at the official window week on week to close at N1531as demand pressure was reduced by the Central Bank FX intervention sales to banks and the fresh dollar supply from foreign portfolio investors (FPIs) looking to participate in the OMO auctions.

In the week, the CBN sold USD170.00 million to banks to strengthen the supply side. Meanwhile, gross FX reserves increased for the eight consecutive week, growing by USD161.06 million week on week to USD41.27 billion. #Naira Forward FX Rates Gain Across Contracts on Renew Confidence Naira Appreciates to N1,535 over Stronger U.S Dollar Supply