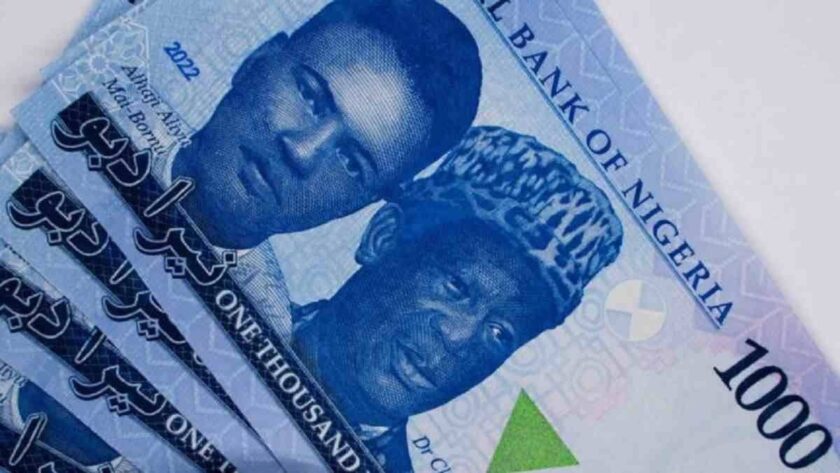

Naira Diverges as Informal Sector’s FX Liquidity Tightens

The naira diverges as the official and parallel exchange rates move in different directions amidst a supply shortfall in the informal sector.

The official rate, however, recorded a weekly gain, which widened the exchange rates between the Central Bank of Nigeria (CBN) and parallel market quotes. The CBN said in its daily fx update that the local currency appreciated to N1423.17 per dollar, gaining N7.70 week on week.

The naira traded at an average of ₦1,421.90/US$ during the week, with inflows from Foreign Portfolio Investors (FPIs) and supply from local participants supporting the rate.

The official rate began the week with a slight appreciation of 1 bps to ₦1,429.31 per USD on Monday and consistently appreciated to ₦1,418.26 per USD by midweek.

However, as demand began to outweigh the available supply, the naira depreciated to ₦1,423.17 per US dollar by the end of the week. In the parallel market, the naira fell by N5 week on week to close at N1480, reflecting tight US dollar supply.

Hence, FX spread widened to 3.99% from 3.09% in the prior week, according to TrustBanc Financial Group Limited amidst growing external reserves. The CBN updated data showed that Nigeria’s gross external reserves rose by $100.56 million to $45.67 billion amidst uncertainties in the global commodity market.

Despite an early decline in oil prices amid supply disruptions from Venezuela, global crude markets ended the week significantly higher on growing concerns over supply risks linked to intensifying protests in Iran and escalations in Russia’s war with Ukraine.

Brent crude gained $2.59, or 4.26% w/w, to settle at $63.34 per barrel, while U.S. West Texas Intermediate (WTI) rose $1.80, or 3.14% week on week, to $59.12 per barrel.

Gold prices also traded mostly positive and recorded a weekly gain, supported by weaker-than-expected U.S. payrolls data and broader policy and geopolitical uncertainty.

Spot gold climbed 4.16% w/w to finish at $4,510.45 per ounce, while gold futures increased 3.58% w/w to close at $4,500.90 per ounce, reflecting sustained safe-haven demand amid ongoing market uncertainty.

Analysts at AIICO Capital anticipate the market to remain cautious and data-driven next week, with investor focus on upcoming U.S. jobs data shaping risk sentiment, while commodity prices—especially oil supported by supply disruption concerns in Venezuela and Iran—may continue to influence broader market direction. Eterna Opens Rights Issue at 37% Discount to Raise Capital