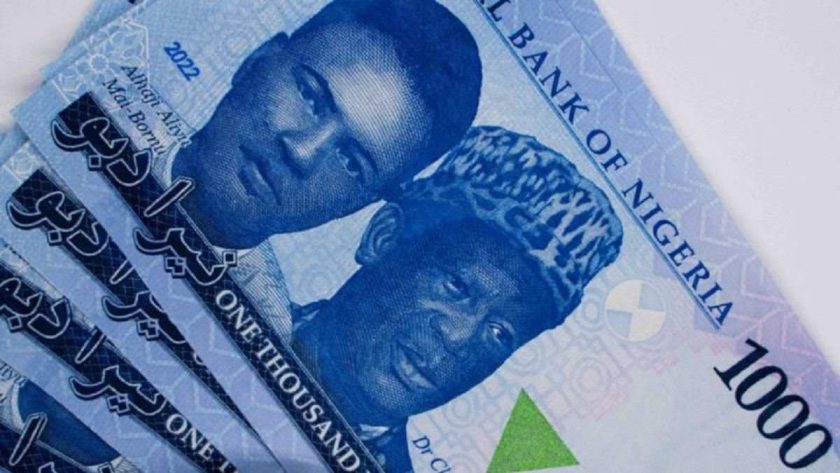

Naira Dips as Nigeria’s Foreign Reserves Fall by $1.34bn

The Nigerian local currency, the naira, dipped slightly against the US dollar in the official window over mild FX pressures. This week, the naira has been trading negatively against the US dollar amidst declining external reserves. In the official window, liquidity level has remained strong due to improved offshore investors’ participation in the economy.

Also, the Central Bank of Nigeria has continued to boost FX supply in addition to the positive impact of exporters’ inflows after the CBN suspends export proceeds repatriation extension. FMDQ spot data revealed that the naira depreciated by 0.05%, closing at ₦1,499.76 per US dollar, marking the third lower rate of pricing in the new week.

The naira exchange rate slipped despite a fair amount of liquidity at the Nigerian Foreign Exchange Market, with most of the transactions occurring between N1,469 and N1,510.00. Foreign inflows remained strong, AIICO Capital Limited said in a note, adding that the outlook for the naira seemed poised for further stability.

Last week, the local currency appreciated strongly as the Central Bank of Nigeria’s (CBN) FX interventions and inflows from international oil companies and foreign portfolio investors kept liquidity levels high and sufficient for foreign payments.

However, gross balance in Nigeria’s foreign reserves declined further from a three-year high, down by $1.34 billion year to date. Gross external reserves nosedived successively over the past few weeks as a result of FX outflows relating to foreign obligations, including US dollar auctions offered to local banks.

Data from the CBN showed external reserves dropped to $39.548 billion this week from $40.883 billion at the beginning of 2025. The monetary authority is doing everything to keep the naira stable across foreign exchange markets, analysts said in a forum organised by MarketForces Africa on Wednesday in Lagos.

They maintained that foreign investors now have strong confidence in Nigerian financial markets due to market-wide reform that has removed lacunae in capital repatriation.

In the parallel market, the naira appreciated to ₦1,555 per dollar, a development supported by the CBN decision to extend $25,000 FX sales to Bureau de Change (CBN) operators at the official rate. In the global commodity market, oil prices experienced a decline of over 2% due to a significant rise in U.S. crude and gasoline stockpiles, indicating weaker demand.

Additionally, concerns about a potential China-U.S. trade war contributed to fears of slower economic growth. Brent crude futures fell by $1.55, or 2.03%, to $74.65 a barrel, while U.S. West Texas Intermediate crude (WTI) decreased by $1.57, or 2.16%, to $71.13. In contrast, gold prices continued to rise as investors sought safe-haven assets amid escalating trade concerns.

Spot gold increased by 1.2%, reaching $2,875.15 per ounce after setting a record high of $2,882.16 earlier in the session. Analysts said if Iranian sanctions are reinstated, the resulting supply constraints could maintain rising oil prices, especially with OPEC+ producers’ anticipated adjustments falling short of expectations. #Naira Dips as Nigeria’s Foreign Reserves Fall by $1.34bn Oil Prices Rally as U.S Tariffs Raise Supply Risks