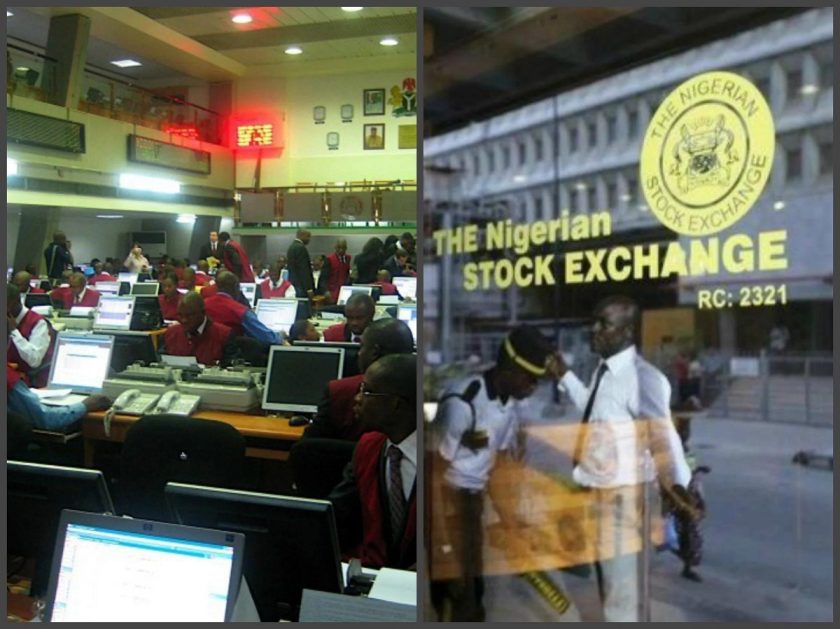

Investor Lose N1.6trn as Prices of Banks Shares Plunge

The Nigerian Exchange equities market capitalisation declined by more than N1.6 trillion in a week due to sustained risk off sentiment on banking stocks. The local bourse has been bleeding since five weeks due to low sentiment in the equities space.

In the just concluded week, the domestic equities market saw another pullback amidst elevated yield in the fixed interest income market. Market index is dragged due to solid yields in the alternative investment window attract institutional investors.

These investors are selling down their shareholdings in the banking sector amidst recapitalisation programme – with about #3 trillion funding gap. Presidential CNG Set for MAY Rollout – Onanuga

According to data obtained from the Nigerian Exchange, the benchmark all-share index trended southward by 2.71% week on week to close at 99,539.75 points.

Equities performance went southward in all sessions, dropping by 2.71% to close at N56.30 trillion on Friday as expectations for dividend earnings season and Q1 2024 corporate earnings waned.

Trailing Nigeria’s annual inflation of 33.20 in March, the year to date return of the market printed lower at 33.12%, a steep decline from 36.83% recorded in the prior week.

Trading activity this week was positive despite a weakened market breadth as evidenced in the total number of losers that outnumbered the gainers in the ratio 62:13.

As a result, the weekly traded volume advanced by 41.07% week on week to 1.59 billion units consummated in 44,915 deals, Cowry Asset Management Limited said in its market update.

This indicates a 104.9% uptick during the week. In the same manner, the traded value for the week soared further by 12.78% week on week to N32.31 billion, Cowry Asset stockbrokers reported.

The top traded stocks by volume were ACCESSCORP (176.5m units), UBA (171.3m units) and ZENITH (124.7m units), Afrinvest said in its market update,

On the sectoral performance, the NGX-Banking index led the losses by 11.46% week on week driven by adverse price movements in GTCO, UNITYBNK, JAIZBANK, UBA and ACCESS.

Trailing on the losers table were the NGX-Insurance (2.80%), NGX-Industrial Goods (2.71%), and NGX-Consumer Goods (0.96%), which got dragged by southward movement in CHAMS, SUNUASSUR, DANGSUGAR, UNILEVER, FLOUR and OANDO respectively.

NGX Oil & Gas Index stayed muted from last week’s close.

At the close of the week, the best performed stocks included MORISON (45%), GUINNESS (10%), ACADEMY (10%), PRESTIGE (9%), and NEM (9%).

However, the worst performance stocks for the week are GTCO, UNITYBNK, LIVESTOCK, JAPAULGOLD, and CHAMS as their share prices plummeted by 19% apiece.

The current trend of corrections and pullbacks are expected to continue on the back of portfolio rebalancing, and sector rotation by investors and fund managers, Cowry Asset Management Limited said in its update.

“We think investors will closely monitor expected earnings numbers, published macroeconomic data and government policy direction for further guidance. Meanwhile, we continue to advise investors on taking positions in stocks with sound fundamentals.

Overall, equities market capitalisation declined by N1.6 trillion or 2.7% to ₦56.3 trillion with year to date return cut back to 33.1%.