FX Policy, Oil Recovery to Reduce Nigeria’s Current Accounts Deficit -CHD

The Nigeria’s central bank foreign exchange (FX) management and sustained recovery in global prices of oil have been projected to reduce the nation’s current account deficit in 2021.

In a macroeconomic report on Monday, analysts at Chapel Hill Denham (CHD) estimate deficit of $10 billion from expected level at $15.7 billion in 2020.

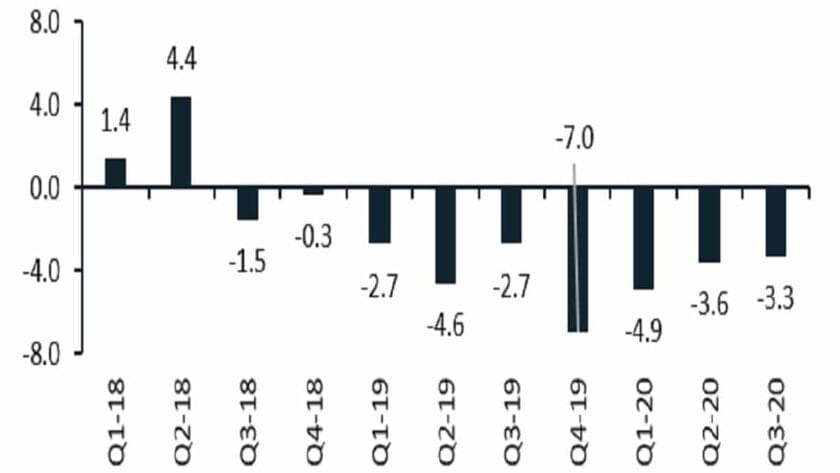

Based on latest data from the CBN, Nigeria’s external imbalances remained wide in the third quarter (Q3) of 2020.

This imbalance was spelt out as the current account deficit expanded by 23.3% year on year to US$3.3 billion or -3.2% of GDP from US$2.7 billion or -2.2% of GDP in Q2-2019.

However, on a quarter-on-quarter basis, Chapel Hill Denham said the current account deficit was an improvement from Q2-2020 print of US$3.60 billion or -3.8% of GDP.

Most of the deceleration stemmed largely from a significant expansion in current transfer, rising +11.5% quarter on quarter and 29.8% quarter on quarter decline in service net debit position.

Both of these masked the19.7% quarter on quarter expansion in the trade deficit and income net debit position increase of +19.5%.

“At this run-rate, the current account deficit is looking set to close the year at US$15.7 billion or -3.7% of GDP as against -US$17.02 billion or -3.6% of GDP in 2019”, Chapel Hill Denham estimated.

“Looking ahead, we believe that the CBN’s FX policy and recovery in oil price will combine to help deliver a smaller current account deficit in 2021, estimated at US$10 billion.

“Nonetheless, we do not rule out further naira adjustment this year. The naira is expected to weaken at the I&E Window rate to N430 in 2021”.

Market data indicates that the exchange rate closed flat at N379.00 and N380.69 at the official and secondary market intervention sales window.

Due to CBN FX policy, analysts said although the average daily turnover at the I&E Window fell by 17.3% week on week (wow) to US$61.38 million, the Naira appreciated slightly by 0.13% wow to N394.17.

Meanwhile, pressures eased at the parallel market, with the Naira closing some gaps against the dollar by 0.42% wow or N2.00 to N475.

In a related development, sentiments were broadly mixed in the fixed income market last week as yields expanded at the long end of the curve.

Analysts attributed this to duration apathy, amidst monetary policy uncertainty, while short term rates compressed due to risk aversion which induced short duration positioning.

On a week-on-week basis, yields across the benchmark bond yield curve expanded by an average of 34 basis points (bps) to 7.30%.

Meanwhile, open market operations (OMO) benchmark curve compressed by an average of 3bps to 0.78%, and the Treasury bill curve was flat at an average of 0.48%.

Chapel Hill Denham expressed view that the Debt Management Office (DMO) first monthly bond auction of the year, which held last week Wednesday, played a major role in the direction of fixed income yields.

At the auction, the DMO offered N150 billion, split equally across three tenors (MAR 2027, MAR 2035, and JUL 2045).

However, analysts said subscription was decent at N238.28 billion, implying a bid-cover ratio of 1.9x compare to 2.2x recorded previously.

However, due to investor demand for high yields, the DMO allotted only N122.36 billion at the auction, and issued another N48 billion as non-competitive allotment, bringing the total sale to N170.36 billion.

Consequently, marginal rates expanded across tenors, with the MAR 2027 clearing at 7.98%, MAR 2035 at 8.74% (+180bps) and JUL 2045 at 8.95% (+195bps). Following the auction, the hitherto wide bid-ask spread narrowed slightly, as offers adjusted higher to the auction yield level, while bids moved lower in response to the DMO’s resistance.

“The combination of depressed short term rates and recent expansion in bond yields, has led to the steepest Naira yield curve since March 2020.

“This week, two events could provide more clarity to investors on the direction of rates in the short term.

“Firstly, the MPC is scheduled to hold its first meeting of the year between today and tomorrow (Monday 25th and Tuesday 26th January).

“We expect the MPC to maintain status quo at the meeting – retaining the MPR at 11.5% and holding all variables constant – against the backdrop of weak economic output and stronger COVID-19 infection wave forcing more economic restrictions.

“Notwithstanding, the market will be looking for clues on short- to medium-term monetary policy direction.

“Secondly, a rollover treasury bill auction is scheduled to hold on Wednesday, with the DMO expected to offer a total of N187.3 billion.

Current Account Deficit: Currency Adjustment inevitable in 2021 –Analysts

“With the yield curve at the steepest level since March 2020, a surprising auction by the CBN will have implications on the slope of the yield curve and broader investor sentiment”, Chapel Hill Denham stated.

FX Policy, Oil Recovery to Reduce Nigeria’s Current Accounts Deficit -CHD