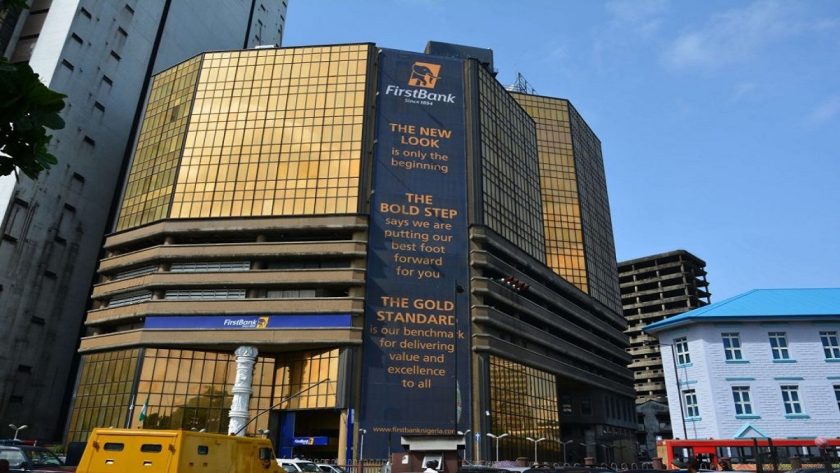

FBN Holdings Shrinks Below N1 Trillion Again

Financial services group, FBN Holdings Plc gave up huge parts of gains recorded on the Nigerian Exchange (NGX) as merchant business divestment driven rally eased.

In the just concluded week, FBN Holdings Plc lost about N162 billion in the equities market due to hot selling rallies.

The Marina based banking group is now trading at more than 43% discount to its 52-week high in the equities market amidst indefinite shareholders meeting postponement.

Data from the local bourse revealed that FBN Holdings opened the week at N29.50 but ended much lower at N25 per share on Friday, translating to 15.25% weekly loss.

The market has now discounted the group decision to selloffs FBNQuest Merchant Bank, a move that analysts believe was as a result of additional capital injection by regulator.

While legal tussle with Barbican Capital Limited continues, FBN Holding chair Femi Otedola took advantage of lower price to increase stake in the banking group.

In September, Otedola ramped up 534,094,407 shares at the average market price of N30, according to a regulatory filing. The effect of N16 billion share purchase did not last longer as other shareholders were selling down interest.

Details from insider dealing note submitted on the Nigerian Exchange revealed that Otedola mopped up more shares between Sept 23 and 25.

MarketForces Africa reported that the market value of FBN Holdings rose strongly to around N1.2 trillion but could not keep up the pace before it started falling. # FBN Holdings Shrinks Below N1 Trillion Again

Arbitrary bank charges: CBN urges Customers to Report Illegal Charges