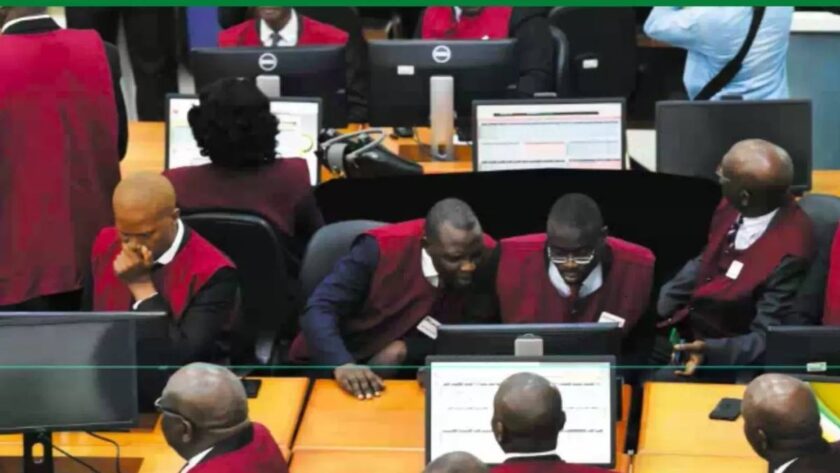

Equity Investors Open Nigerian Exchange with N562bn Gain

Equity investors trading highs and lows in the Nigerian Exchange (NGX) saw about N562 billion in gains in the first trading session in 2026 due to positive sentiment carried over from last year’s rally.

The market experienced bargain hunting across the sectoral indices, with significant interest in financial stocks ahead of fourth quarter of 2025 earnings release.

The local bourse opened the year strong as the All-Share Index (ASI) advanced by 0.57% to 156,492.36 points. With the activities of value hunters, NGX market capitalisation grew by ₦561.55 billion to ₦99.94 trillion.

Stockbrokers reported that market sentiment was strongly favourable at 5.3x, with 53 advancing stocks outweighing 10 declining counters.

ABCTRANS, FTNCOCOA, MBENEFIT, DEAPCAP, and ALEX emerged as top performers, whereas ABBEYBDS, FCMB, SEPLAT, GUINEAINS, and UNIVINSURE recorded the largest losses.

Sectoral activity was predominantly positive: Banking led gains with a 2.32% surge, followed by Insurance climbing 2.07%, Oil & Gas rising 1.38%, Commodity increasing 0.71%, and Consumer Goods adding 0.21%, while the Industrial sector remained essentially flat.

Trading metrics showed divergent trends as share volume tumbled 64.22% to 439.95 million units and transaction value fell 28.92% to ₦24.97 billion, whereas deal count jumped 44.33% to 40,245 transactions.

Foreign Currency Inflow into Nigerian Market Sinks by 95%