Equities Investors Gain N256bn as Nigerian Stocks Rally

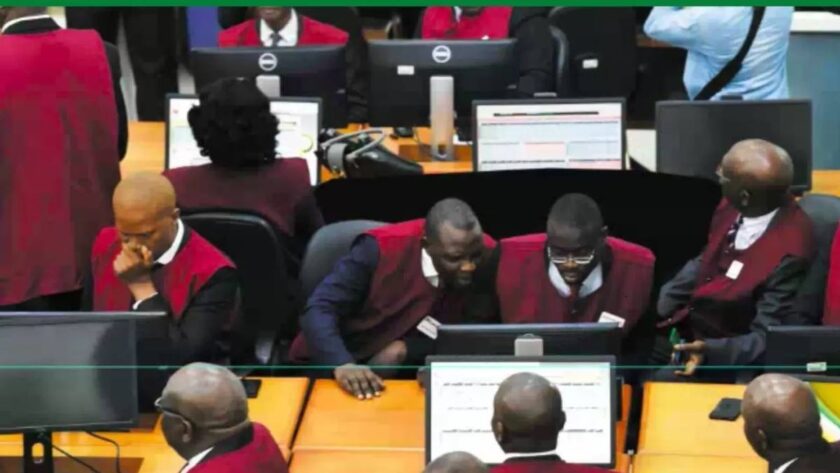

Nigerian stocks rally on Monday due to sustained bargain hunting ahead of fourth-quarter earnings season. Equities investors trading highs and lows in the Nigerian Exchange (NGX) gained more than N256 billion as sentiment improved.

The local sustained its upward trajectory on Monday, commencing the week with the All-Share Index climbing 0.26% to 152,459.07 points.

Stockbrokers reported that market capitalisation grew by N256 billion to N97.19 trillion, driven by investors realigning their portfolios in anticipation of the New Year.

The gain in today’s session was driven by renewed positive sentiment in BUACEMENT (+2.35%), INTBREW (+4.17%) and FIRSTHOLDCO (+2.34%), which outweighed the impact of selloffs in UBA (-2.50%) and CUSTODIAN (-10.00%).

Market breadth was positive at 1.7x, with 34 gainers surpassing 19 losers. ALEX (+9.72%) led the gainers list, while ABCTRANS (-10.00%) and CUSTODIAN (-10.00%) topped the laggards.

Elsewhere, trading metrics declined as the total volume traded reduced by 70.0% to close at 451.5 million units traded, while total value declined by 40.3% to settle at N13.0 billion.

TANTALIZER led the volumes chart with 50.2 million units (11.1% of total volume), while ARADEL topped the value chart with trades worth N1.5 billion (11.6% of total value).

Sectoral performance was mixed, with gains observed in 3 out of 6 major indices. The Industrial Goods Index (+0.91%) advanced on the back of gains in BUACEMENT (+2.35%), while the Consumer Goods Index (+0.50%) was lifted by the price uptick in INTBREW (+4.17%).

The Commodity Index (+0.14%) also closed higher, supported by demand for PRESCO (+1.40%). Conversely, selloffs in NEM (-3.80%) and UBA (-2.50%) weighed on the Insurance (-0.54%) and Banking (-0.04%) indices, respectively. Elsewhere, the Oil & Gas Index remained flat.

Lafarge Africa Delivers 90% Return, Recommends for Dec. Upside