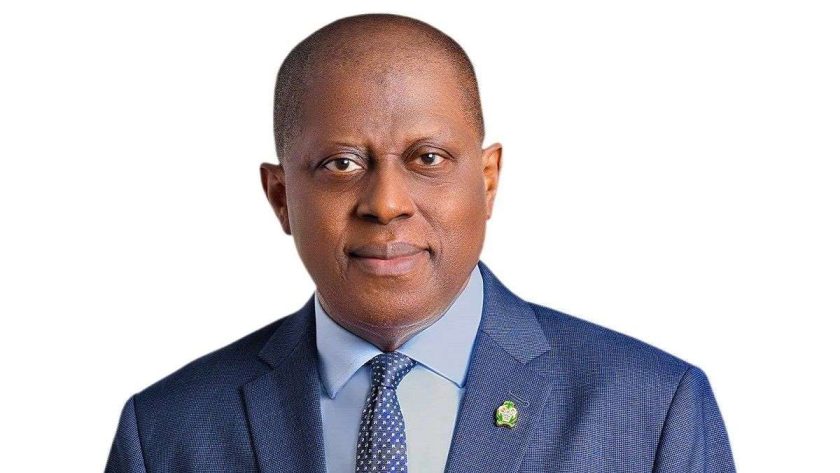

Energy Prices, FX Stability Drive Disinflation, Cardoso Says

Yemi Cardoso, Governor of the Central Bank of Nigeria (CBN), has attributed the decline in headline inflation in June to moderation in energy prices and stability in the foreign exchange market.

Cardoso said this on Tuesday in Abuja while presenting a communiqué from the 301st meeting of the apex bank’s Monetary Policy Committee (MPC). He noted, however, that there was an uptick in month-on-month headline inflation, suggesting the persistence of underlying price pressures.

According to him, continued global uncertainties associated with tariff wars and geopolitical tensions can further exacerbate supply chain disruption and exert pressure on the prices of imported items.

“Members also noted the continued stability in the banking system, evidenced by the stable Financial Soundness Indicators (FSIs), which would further be supported by the ongoing banking recapitalisation exercise,” he said.

He added that eight banks had fully met the recapitalisation requirements, while others are making progress toward meeting the deadline.

“The MPC, thus, urged the management of the CBN to sustain its oversight of the banking system to ensure continued resilience, safety, and soundness of the financial system.

“Regarding price and other domestic developments, headline inflation (year-on-year) declined to 22.22 per cent in June from 22.97 per cent in May, primarily driven by the moderation in energy prices, especially cooking gas, wood charcoal, and diesel.

“Food inflation (year-on-year), however, rose to 21.97 per cent in June from 21.14 per cent in May, attributed mainly to the increase in the cost of processed food.

“Core inflation, that is, all items less farm produce and energy, also increased to 22.76 per cent in June from 22.28 per cent in May,” Cardoso stated. He said that this reflected an uptick in the cost of Information and Communication, Housing and Utilities, and Personal Care and Social Services.

According to him, on a month-on-month basis, headline inflation rose to 1.68 per cent from 1.53 per cent, largely due to increases in the price of services and imported food. He also said that the MPC acknowledged the efforts of the Federal Government in improving security and its impact on food production.

“Members urged the government to continue its support toward the timely provision of high-yield seedlings, fertilisers, and other critical inputs for the current farming season,” he said.

MPC had earlier announced the retention of the Monetary Policy Rate (MPR) at 27.5 per cent. All 12 MPC members present at the meeting also voted unanimously to hold all key monetary parameters constant.

The committee also retained the cash reserve ratio (CRR) at 50 per cent for deposit money banks and 16 per cent for merchant banks. It also retained the liquidity ratio at 30 per cent and the Asymmetric Corridor at +500/-100 basis points. #Energy Prices, FX Stability Drive Disinflation, Cardoso Says NNPC Posts N905bn June Profit, Remits N6.96tn in 5 Months to FG