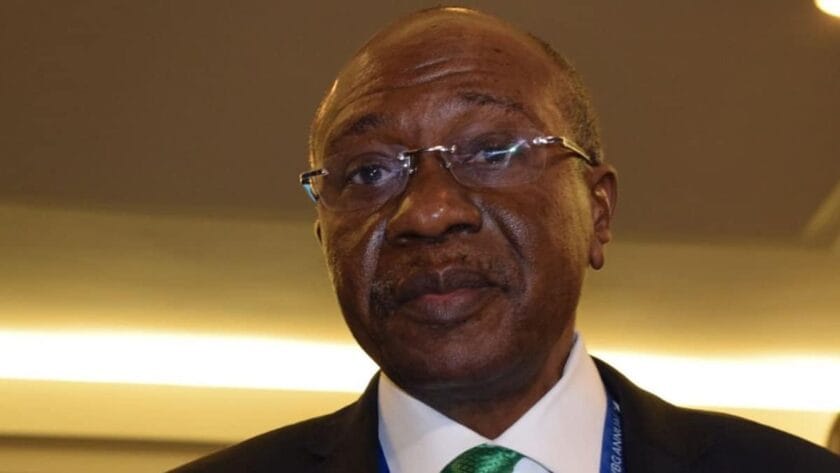

Emefiele Shows Preference for Policies that Boost Domestic Supply Capacity

Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN) emphasized the need to bolster domestic supply while noting that inflation inertia may reverse as supply network improves.

Emefiele policy stance was revealed in the November communique of the Monetary Policy Committee (MPC) meeting posted on CBN website.

The CBN chief explained that due to challenging first half of the year, global economic output showed improvements in the second half of 2020.

He said this comes as the world learns to live with COVID-19 and as containment measures were eased, allowing businesses to reopen.

Read Also: Rising Inflation: Analysts Predict Tighter Monetary Policy Regime in 2021

According to Emefiele, uncertain global outlook seems to be dissipating as various national governments adopt expansionary policy measures to boost domestic confidence and fast-track recovery.

He said given the renewed outbreak in many countries, the pace of recovery will depend on how quickly business and consumer confidence are restored.

Although third quarter of 2020 GDP outturn could outperform Q2, most advanced and emerging market economies, except for China, will record recession in 2020.

In the short-term, Emefiele explained that the newly announced COVID-19 vaccine could restore economic confidence and quicken global recovery.

CBN Chief stated that for 2021, though a fragile recovery is expected in many countries, output may be below projected pre-pandemic levels.

In his note, Emefiele submitted that domestic economic conditions and short-term outlook improved noticeably in Q3-2020 as lockdowns were increasingly eased and activities progressively normalise.

This followed the prompt and extensive reaction of policymakers to cushion the adverse effects of the pandemic, restart the economy, and accelerate recovery, he added.

The report reads that though current macroeconomic conditions remain fragile, steeper rebound could begin by Q4-2020.

It was noted that from -6.1 percent in Q2-2020, output contraction improved to -3.6 percent in Q3-2020.

Emefiele said this trajectory was significantly better-than-envisaged and suggests the likelihood of a positive outcome by Q4-2020.

Explaining further, he said the result was derived from improved performance of the non-oil sector which eased from a contraction of -6.1 percent to -2.5 percent as against the worsening pace of oil GDP from -6.6 percent to -13.9 percent in the same period.

However, the apex bank chief added that the non-oil sector remains the bedrock of the domestic economy.

Explaining further in the note, Emefiele stated that various efforts at stimulating and bolstering productivity in the nonoil sector must be reinforced.

“With prevailing disruptions in the international oil market, the need to rebalance our economy and strengthen its structural base remains sacrosanct.

“A complete and quickened diversification from oil is needed to insulate the economy and reduce our vulnerability to undue external shocks”, he wrote in his submission.

After fourteen consecutive months of uptick, year-on-year headline inflation, at 14.2 percent in October 2020 vis-à-vis 13.7 percent in September showed persistent pressures.

This reflected the 72 basis points increase in food inflation to 17.4 percent and 56 basis points rise in core inflation to 11.1 percent.

The CBN Chief maintained that disruptions to supply network (either due to COVID-19 or insecurity) and the concomitant food shortages significantly elevated headline inflationary pressure and may persist if not corrected.

Nonetheless, he opined that the envisaged increase in the volume of domestic supply, following CBN interventions to boost production and speedup recovery may asymptotically lower inflation inertia by mid-2021.

Again, he explained that the current stagflation poses a dilemma for policy making and continues to highlight the importance of a strengthened productive base.

“It underscores the need for fast-tracked diversification and sustained support of the real sector through growth enhancing policies.

“I note the CBN’s development finance initiatives to minimise the adverse impact of the COVID-19 pandemic, resolve underlying structural deficiencies, and speed-up recovery.

“The liquidity support covers various economic activities and aims to narrow supply shortages within the economy and boost consumer spending.

“I remain confident that an effective correction of the supply shortages (especially in farm produce) will have the dual effects of boosting output and moderating inflation”, Emefiele submitted.

Explaining his position, Emefiele stated that domestic financial market conditions were diverse, with a bullish stock market, liquid money market, and persisting exchange market pressure.

Analysis of liquidity conditions indicates expansion in monetary aggregates in October 2020 as broad money supply recorded an annualised growth of 4.2 percent.

“This follows the 9.1 percent annualised growth in aggregate domestic credits, highlighting the efficacy of our interventions and LDR policy”, he added.

He stated that since May 2019, gross banking system credit grew by nearly N4 trillion to N19.5 trillion at mid November 2020.

Emefiele believes that yet, the Nigerian banking system remained largely sound as key financial soundness indicators (FSI) including non-performing loans and capital adequacy ratio showed continued improvements.

Amidst exchange market pressure, it was noted that external reserves stayed above US$35 billion though uncertainty could undermine expectations of future output and price trajectories.

“In my consideration, I stress the need for policy that impact positively on the lives and livelihoods of Nigerians.

“I note that we have entered a second recession in 4 years, due largely to our vulnerability to external shocks.

“As the biggest economy in Africa, we need to reverse this trend, diversify away from oil and insulate our economy from undue shocks.

“I emphasise the need for policymaking that will bolster the productivity of non-oil sector and boost local production especially in the agriculture and industry sectors.

“At this critical time, I note again the need to resolve structural constraints, sustain real sector support, stimulate aggregate supply and enhance job creation.

“I note again the dilemma of stagflation as inflation ascends and output contracts. The undesired policy trade-off from this requires delicate balancing.

“While the primacy of price stability is acknowledged, I note that ignoring the need for output stabilisation at this critical time could have severe long-term consequences for the economy”, CBN Chief explained.

He added that though inflation expectations are elevated, growth outlook is fragile.

In the report, the CBN Chief said it is imperative and urgent to restart the economy now rather than later.

“I am inclined towards measures to boost domestic supply capacity and bolster production as this will not only foster a quick and strong recovery but will also lower the long-run path of inflation.

“I note the need, in this regard, for the CBN to sustain and strengthen its development finance interventions in agriculture, manufacturing, MSMEs, etc., to bolster local capacity and domestic production, enhance job creation, and reduce poverty.

“I note the need for well-balanced policy decision”, he explained further.

Emefiele explained further that tightening, at this time, to curb inflation will worsen recession, while loosening will exacerbate inflationary pressure.

The recent easing of monetary stance, the LDR policy and the various interventions of the Bank are providing adequate liquidity impetus for the real sector, he hinted.

“I am of the view that the impact of these actions should be allowed to completely unfold as the needed impetus to rectify the supply shortage is sufficiently in place.

“Alterations of policy parameters could in my view introduce undue impulses and cause indeterminate equilibrium.

“My inclination is, thus, to hold all parameters.

“I believe the current stance is adequate to attain the long-run objectives of price stability and output stabilisation without complicating recovery”, the CBN Boss stated.

Emefiele Shows Preference for Policies that Boost Domestic Supply Capacity