Average Yield on Nigerian Treasury Bills Rise Further

Average yield on Nigerian Treasury Bills rise to 0.6% from the bottom of the pyramid amidst pressure in the fixed income market.

The sustain rise in rate comes after investors has shunned the instrument when average rate plunged to 0.1%.

In a note, Greenwich Trust said that after a quiet trading session on Friday, the T-bills market commenced the new week on a bearish note as investors took profit across the tickers.

The average yield in the T-bills market rose 11 basis points (bps) to 0.6% as a result.

Meanwhile, Chapel Hill Denham said in line with analysts thoughts, the financial system liquidity opened slightly higher at N382.7 billion from N338.7 billion on Friday.

Even at that, analysts said funding pressures were stronger when compared to the last trading day.

Precisely, the Overnight (OVN) and Open Buy Back (OBB) rates expanding by 20bps and 17bps to 1.08% and 0.67%, respectively.

Analysts said an open market operation (OMO) maturity worth N337.64 billion is expected to hit the system Tuesday.

It was however noted that the impact of the inflow would leave the funding rate benign barring any aggressive liquidity sapping programme by the apex bank.

In the fixed income market, the average rates dipped by 3bps at the secondary OMO segment to close at 0.41%.

This was driven mostly by a sustained accumulation of selected maturities across the curve.

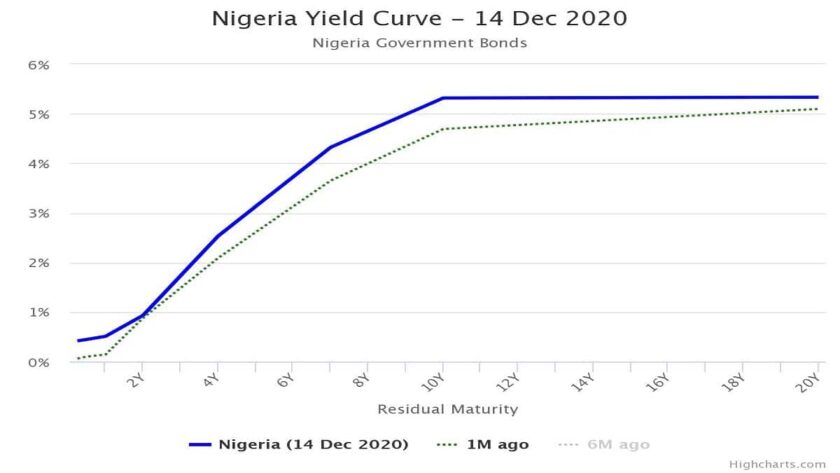

Elsewhere, in the bond segment, the market traded bearish today as investors sold-off the mid day-to-maturity (DTMs) instruments.

Precisely, yields expanded by as much as 35 bps on average across the benchmark curve to close at 5.26%.

This was driven mostly by the sell-offs in the mid DTMs (+65bps to 5.67%) and short (+26bps to 2.48%) tenured instruments.

The long end of the curve closed flat at 6.93%

Analysts expect a bond auction to be conducted by the Debt Management Office on Wednesday.

The total amount on offer is N60 billion, divided equally across the MAR2035 and JUL2045 instruments, respectively.

Chapel Hill Denham said the sizeable OMO maturity which is expected on Wednesday should support demand in our view.

In the currency market, the exchange rates were unchanged at N379.00, N380.69, and N394.00 at the official, SMIS windows, and the I&E Window, respectively.

Similarly, the Naira closed flat at the parallel market at N475.00.