Average Rate on Nigerian Treasury Bills Spikes 30 Basis Points

Average rate on the Nigerian Treasury Bills (NTB) in the secondary market increased by 30 basis points to 0.44% on Wednesday, supported by strong bearish trades, thus consolidate on initial rise recorded.

Analysts at Chapel Hill Denham said the increase on average rate in the secondary open market operations (OMO) segment of the market was much lower inching up 4 basis points to 0.47%.

This was attributed to the renewed investors’ apathy towards OMO instruments as observed in recent time.

Meanwhile, the market opened with similar liquidity as funding pressures were remained benign.

Precisely, the financial system liquidity opened considerably higher at ₦572 billion from ₦530 billion yesterday.

Thus the Open Buy Back (OBB) and Overnight (OVN) rates moderated by 16basis points and 14basis points to 0.67% and 0.92%, respectively.

We expect this trend to persist throughout the week as buoyant system liquidity continues to support the lower rates in the market.

In the fixed income market, trading activities was broadly bearish.

In contrast to the OMO and NTB market, analysts said trading activities in the bond segment was a mixed bag

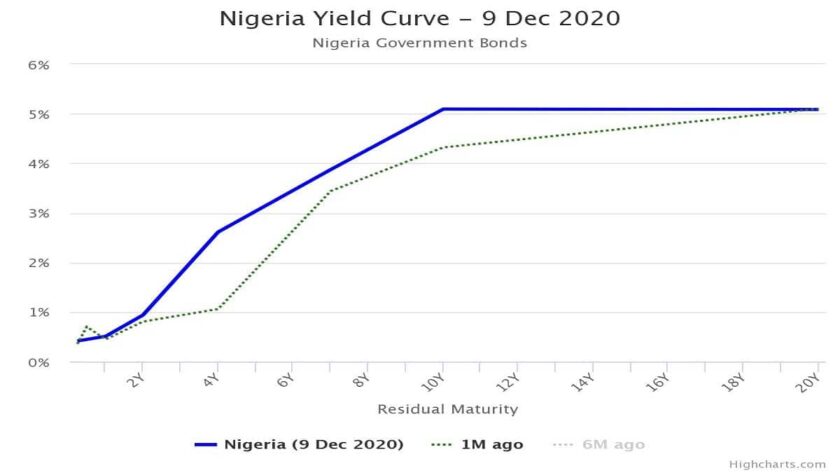

Bond market extended its bear-run to the third consecutive session this week, as yields across the curve rose to average 4.4%, compared to 4.3% on Tuesday.

Read Also: Yield Stays Flat on Subdued Appetite in T-Bills Market

Across the tickers, Greenwich Trust Limited stated that investors sold the short end (+62 basis points) and belly of the curve (+5 basis points), even as the long end (-23 basis points) was dominated by positive sentiment.

The 23-MAR-2025 instrument (+216bps) and 18-APR-2037 instrument (-122bps) saw the biggest yield increase and yield decline, respectively.

The CBN, on behalf of the DMO, conducted a primary market NTB auction, offering and allotting ₦50.93 billion.

Subscription (total reached ₦102.97) on the offer was benign, with a bid-cover of 2.02x as against 2.96x at the last auction in November.

Notably, stop rates on the auction was lower across the 91-day (-1 basis points to 0.01%), and 182-day (-3 basis points to 0.06%) tenors, but rose by 305 basis points on the 364-day tenor to 3.20%.

“We believe the lower participation in today’s auction is linked to market’s uncertainty as regards the CBN announced special bill auction”, Chapel Hill Denham said.

It explained that investors expect the yield on the bill to be higher, hence the weaker participation in today’s NTB auction.

In the currency market, the exchange rates were unchanged at ₦379.00, ₦380.69, ₦395.00 at the official, secondary market intervention sales windows, and the I&E Window, respectively.

Elsewhere in the parallel market, pressures on Naira moderated as the local currency appreciated ₦5 or 1.05% against the US dollars to close at ₦478.00.