Yields Rise as CBN Issue ₦4trn worth of Special Bills

The Nigerian debt market records an upward repricing of yields Thursday as the Central Bank of Nigeria (CBN) offered special bills at 0.5% as part of plan to unfreeze excess cash reserves.

Meanwhile, the Treasury bills market closed tepid coming on the heels of CBN’s N102.97 billion Primary Market Auction on Wednesday.

Average rate on secondary Treasury Bills and Open market Operations (OMO) bills were unchanged at 0.44% and 0.47% respectively, at the front end of the yield curve.

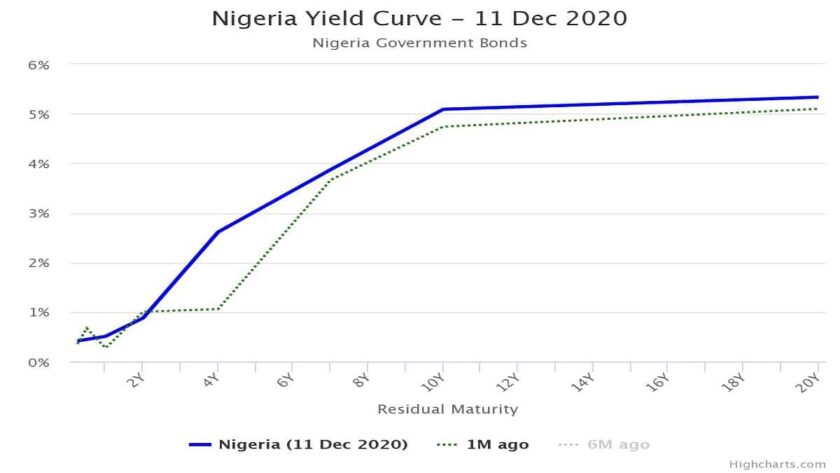

The bond market, the average yield rose by 7 basis points (bps) to 4.58%, driven by upward repricing of yields at the short (+1bp to 2.25%) and the long (+22bps to 6.26%) end of the yield curve.

The CBN, conducted a special bills auction, selling an 81-day bill at 0.5% discount rate to the banks.

The size of issuance is estimated at about N4 trillion, following the refund of a sizable portion of the bank’s excess CRR by the CBN to Deposit Money Banks.

“We believe this auction will likely ease the current uncertainty in the fixed income market, as the auction confirms that the CBN remains dovish and accommodative over the near term”, Chapel Hill Denham said.

Overall, supportive financial system liquidity has kept rates in the market benign. Precisely, the financial system liquidity opened slightly lower at N513 billion from N530 billion on Wednesday.

Thus the Open Buy Back (OBB) and Overnight (OVN) rates inched up by 33bps and 52bps to 1.00% and 1.44%, respectively.

For the rest of the week, analysts at Chapel Hill Denham said they expect buoyant system liquidity to continue to support the lower rates in the market.

Read Also: Nigerian Treasury Bills Market Records Strong Demand

In the currency market, exchange rates were unchanged at N379.00, N380.69, N395.00 at the official, secondary market intervention sales windows, and the I&E Window, respectively.

Elsewhere in the parallel market, pressures continued on the Naira, with the local currency appreciating by N2.00 or 0.42% against the US dollars to close at N476.00.