Profit-taking Dominates Bonds Market Activities, Investors Ignore T-Bills

Investors’ apathy towards secondary Nigerian Treasury Bills (NTBs) market was sustained as the yield curve closed flat at 0.1%.

Today, funding rates were benign, pressured by the sturdy banking system liquidity.

As against previous day, financial system liquidity opened at ₦515.13 billion, albeit 16.6% lower.

Thus, Open Buy Back and Over Night rate trended south to 0.5% and 0.9% respectively from 0.7% and 1.0%.

“We remain resolute with the view that supportive system liquidity will continue to keep funding pressure in check through the rest of the week”, Chapel Hill Denham said.

Greenwich Merchant Bank in a note said yields in the open market operations (OMO) market were elevated by sharp profit-taking along the mid and long end of the market.

Notably, the short end of the market stayed flat, reflecting the bearish tone, yields rose 10bps to average 0.2%.

Read Also: Debt Market Investors Wait on Sideline in Anticipation of CBN Special Bills

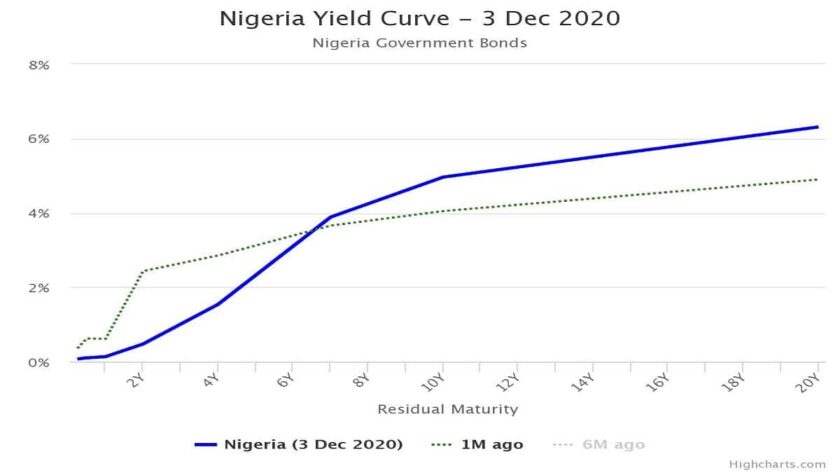

Elsewhere, the bears strengthened their hold in the Bonds market lifting yields 20bps higher to an average of 4.1%.

Across the tickers, the intermediate section of the curve (+52bps) drove the market compared to the long end (+4bps) and the short end (+1bp).

The sell pressure was most pronounced across 26-APR-2029 (+78bps), 22-MAY2029 (+75bps), 20-NOV-2029 (+70bps) instruments.

The current momentum in the market could persist until the issuance of CBN’s special bills as market players anticipate the yield level.

Meanwhile, Naira firmed up by ₦15.00 per United States Dollar (USD) to trade at ₦470.00/USD, from ₦485.00/USD.

The development is connected to the fact that sell-pressure in the parallel market has waned on recent policy moves by the CBN.

Week-to-date, the local currency unit has appreciated by 6.0% or ₦30.00 at the unofficial market.

At the Investors and Exporters foreign exchange window, the Naira held steady at ₦395.00/USD.