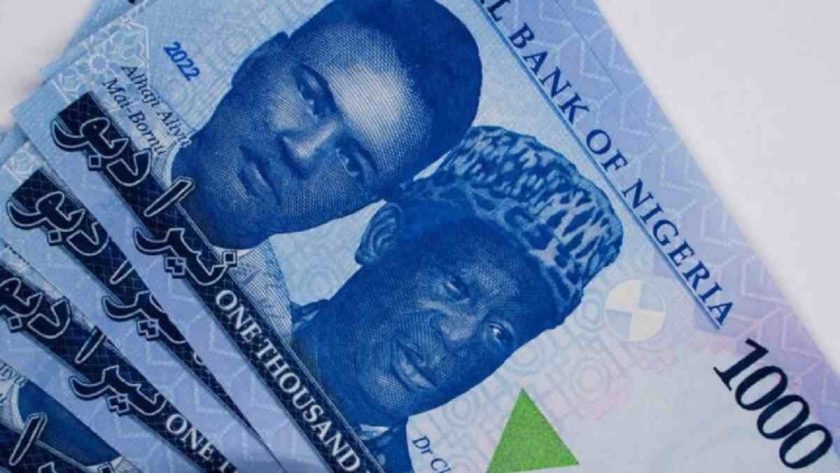

Naira Rallies as CBN Intervention Keeps FX Market Liquid

The naira rallied against the US dollar after the Central Bank of Nigeria (CBN) foreign exchange market intervention boosted liquidity. Spot FX data from the CBN platform showed that the exchange rate settled at N1518.88 at the official window, reflecting reduced liquidity pressure experienced last week.

The recalibration of the naira exchange rate followed $50 million in FX sales to authorised dealers last week when it became necessary for the CBN to intervene in the official window. The authority sold dollars to banks as companies FX demand outpaced the amount of US dollar volume available on Thursday and Friday.

According to Coronation Merchant Bank’s research subsidiary, foreign exchange inflows declined to US$749.8 million in the official window, representing more than a 57% weekly drop from US$1.76 billion in the prior week.

External Reserves

Nigeria’s external reserves climbed to $37.432 billion, according to the latest data update from the CBN. Nigeria’s foreign reserves started the latest round of inflows in July following a series of outflows that plunged it to $37 billion.

The CBN would require a strong external reserves buffer to address the FX inflows gap in the currency market on a timely basis, analysts said, adding the otherwise exchange rate stability will be lost. In the first half of the year, the CBN defended the naira with $4.75 billion via aggressive FX intervention sales to banks, and other authorised dealers.

The CBN FX sales to banks, and Bureau de Change (BDCs) operators drive near convergence in the naira exchange rates across the official and parallel market.

Oil Market

Last week Brent Crude closed at US$70.36 per barrel, gaining 3.02% from US$68.30 per barrel in the prior week. The uptick brought its year-to-date (YTD) loss down to 5.73%, compared to 8.49% in the preceding week, Coronation Research said in a note.

Analysts stated that the average trading price now stands at US$73.15 per barrel, representing an 8.40% decline relative to the 2024 average of US$79.86 per barrel. Similarly, Nigeria’s grade, Bonny Light Crude, also closed stronger at US$72.81 per barrel, up 1.38% from US$71.82 in the prior week.

Notably, Bonny Light maintained a premium of US$2.45 per barrel over Brent, although this narrowed from US$3.52 the previous week. So far this year, Bonny Light has recorded a 3.54% YTD loss, with an average trading price of US$74.93 per barrel.

The recovery in crude prices during the week was supported by a combination of geopolitical and macroeconomic factors. Market sentiment improved as ongoing tensions in the Middle East, particularly renewed drone attacks near key oil infrastructure in the Red Sea, re-ignited supply risk concerns.

Also, the US government stated that a big announcement in regard to Russian sanctions, which helped support higher all prices as many analysts expect new and tougher sanctions to be announced, which might affect Russian oil supply.

In addition, a larger-than-expected drawdown in U.S. crude inventories, coupled with a weaker U.S. dollar, buoyed investor appetite for commodities. Hopes of policy easing in China to stimulate economic activity also helped stabilize demand outlooks.

These bullish impulses temporarily outweighed concerns over rising non-OPEC supply and mixed global economic signals. Looking ahead, Coronation Research said the market is likely to remain volatile in the near term as investors weigh supply-side risks against macroeconomic headwinds.

While geopolitical tensions could continue to offer near-term support, persistent demand uncertainty and OPEC+’s production strategy are expected to keep a cap on sustained price rallies. #Naira Rallies as CBN Intervention Keeps FX Market Liquid Foreign Investors Put Nigeria Eurobond on Tab, U.S Yields Shift