Naira Exchange Rates Mixed 31-day After FX Auction

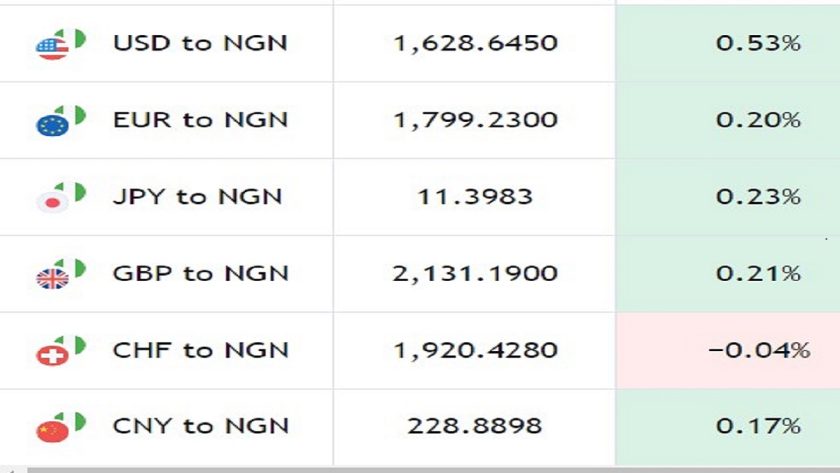

The Nigerian naira exchange rates for obtaining one US dollar ended on a mixed note across the foreign currency markets ahead of the September auction. Naira plunged ahead of N1,600 range at the official window due to increasing demand, which failed to be tamed the devaluation policy.

With the signal that FX demand has eased in terms of volume, the level of supply has persistently threatened the exchange rate across the informal and official currency markets. At the official window, one US dollar note was exchanged for N1,580.46 as pressure eased at the Nigerian autonomous forex market.

Data from the FMDQ platform showed that the naira strengthened again on Monday, gaining 0.81% against the US dollar to close at ₦1,580.46 per US dollar. However, demand pressure in the parallel market led to a 0.61% depreciation of the naira, sliding to ₦1,655 per US dollar, according to a channel check.

Last week, the Central Bank of Nigeria (CBN) offered Bureau de Change (BDC) operators $20,000 at the rate of N1580. The CBN also told informal currency traders not to sell US dollar to FX users at more than 1%.

The naira has been swinging left and right due to a perennial US dollar and other foreign currency shortage in the economy. The CBN has failed to announce details for the September Dutch auction even as gross balances in the Nigerian external reserves begin to climb.

According to data from the Apex Bank website, the total balance in the external reserves climbed to $36.333 billion last week. It has been a month since the CBN sold huge FX to authorised dealer bank after the authority announced the resumption of retail Dutch Auction System sales.

All the bullish predictions on Nigeria’s exchange rate at the official window have failed to nudge the naira higher. Key challenges in the currency market have been negative power. In the global commodity market, oil prices showed a positive trend, with Brent Crude trading at $71.59 per barrel and WTI at $68.27 per barrel on Monday Naira Exchange Rates Mixed 31-day After FX Auction FBN Holdings Divests Interest in Merchant Business to ‘Consortium’