Investors Bet on FGN Bond as Negative Real Return Narrows

Fixed interest securities investors demand for Federal Government of Nigeria (FGN) bonds surged in the secondary market amidst hope inflation would continue to decline throughout the remaining part of the year.

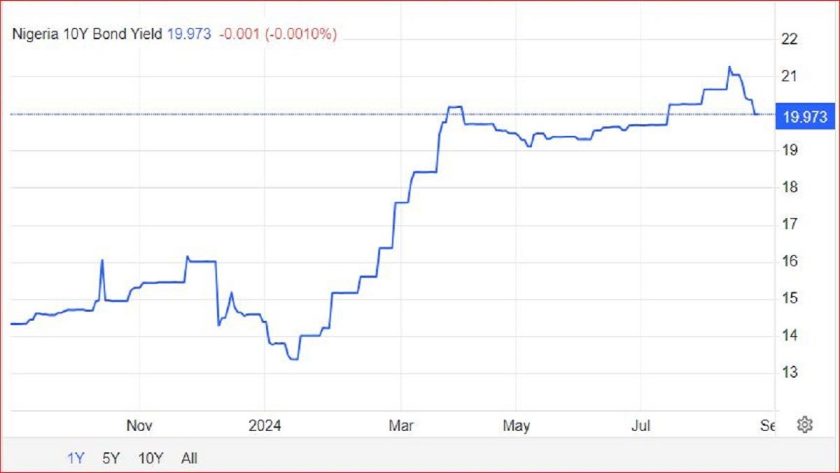

Disinflation that started in July has reduced negative yields on government assets, financial experts said in a Broadstreet meeting with MarketForces Africa. The gap between real returns has collapsed to less than 7% as inflation (33.40%), which caused benchmark interest rate hikes (26.75%), has started falling.

Local investors have been earning negative real return on investment due to elevated inflation positions. Investors are ramping up government bonds, having noted that the Debt Management Office’s (DMO) primary market auction (PMA) size has declined.

The authority has reduced bond offers to investors in the local debt capital market to N190 billion from N300 billion. Though, the DMO allotted more government securities to investors at its August auction due to favourable asset pricing.

The secondary market for FGN bond was slightly bullish on Wednesday with contraction at the mid-segment and long end (-10bps apiece) of the curve due to buying interests in the MAY 33 (+79bps) and JUN 38 (+95 bps), respectively.

Due to buying interest seen on 9-year bond, the average yield consequently declined 6 bps to settle at 19.37%. Across the benchmark curve, the average yield closed flat at the short and mid segments but declined at the long (-10bps) end due to demand for the JUN-2038 (-95bps) bond.

The yield required by investors to extend loans to governments via bond purchases reflects inflation expectations and the likelihood that the debt will be repaid, according to asset managers. #Investors Bet on FGN Bond as Negative Real Return Narrows Interest Rate on Nigerian Treasury Bill Spikes to 21.45%