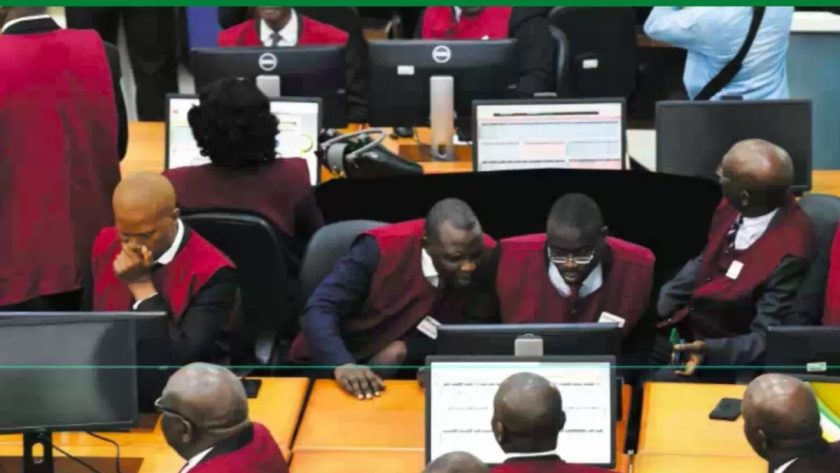

NGX Jumps by N77bn to N35.3trn Amidst Sustain Rally

Recording more than N77 billion weekly gain, the Nigerian Exchange (NGX) equities market capitalisation jumped to N35.5 trillion amidst sustained bargain hunting in the local bourse.

Last week, the market index popped higher as investor wealth spiked by more than N77 billion cumulative across five trading sessions. The market index or the Nigerian Exchange All-share index (NGXASI) rose by 0.2% to close at 65,198.08 points while the year-to-date return grew to 27.2% from 26.9% in the previous week.

However, market activities this week favoured the bears, with both the volume and value of shares traded declining by 9.80% and 21.33%, respectively. According to stockbrokers, activity level worsened as average volume and value traded declined by 9.8% and 21.3% to 514.9 million units and ₦5.9 billion respectively.

A total of 2.58 billion units were traded at a value of N29.62 billion in 37,713 deals, compared to 2.86 billion units valued at N37.65 billion in 41,524 deals traded in the previous week.

In its market update, Afrinvest said top traded stocks by volume were AIICO (335.0m units), FCMB (126.5m units), and UBA (117.7m units), while MTNN (₦2.4bn), ZENITH (₦1.9bn) and GTCO (₦1.8bn) led in terms of value.

Top gainers stocks for the week were SUNUASSURE (+55.0%), CHELLARAM (+45.5%), and ABBEYBDS (+32.7%), while JONHHOLT (-33.2%), OMATEK (-30.6%) and SOVERNIN (-28.6%) led the laggards.

DANGSUGAR (+25%), GLAXOSMITH (+20%), and LINKASSURE (+20%) displayed impressive gains, drawing attention from investors. MTNN (+1.8%), BETAGLASS (+10.0%), and BERGER (+9.5%).

Stockbroking firms said there were buying interest in MANSARD (+17.1%), CUSTODIAN (+9.1%), DANGSUGAR (+25.0%), and NB (+16.4%). There were sell pressures on ETI (-7.9%), FIDELITY (-6.5%),

During the week, some companies posted surprising results, while others fell short of market expectations, leading to notable price movements, according to market analysts.

Cowry Asset Management said with the recent rate hike making fixed income instruments attractive, cautious investors are considering potential inflation hedging strategies within the equity space.

Sectoral performance was mixed, with the insurance sector leading the gainers with a remarkable 5.88% increase. The consumer goods and industrial goods sectors also showed strength, gaining 2.27% and 0.23%, respectively, driven by strong sentiment in mid and high-cap stocks.

However, the banking and oil & gas sectors faced challenges, declining by 2.13% and 0.68%, respectively, as investors cautiously assessed the impact of the rate hike and rising fixed income yields. Market activity remained subdued, consistent with our observations.

Overall, equities market capitalisation saw a modest increase of 0.22% week-on-week, reaching N35.48 trillion from N35.40 trillion in the previous week. #NGX Jumps by N77bn to N35.3trn Amidst Sustain Rally DBN Partners Jaiz, Taj Banks to Support MSMEs in Northern Nigeria